D u b l i n | S h a n n o n | L o s A n g e l e s | S i n g a p o r e | A m s t e r d a m | S h a n

g h a i | A b u D h a b i | S e a t t l e | T o u l o u s e AerCap Investor PresentationAerCap Holdings N.V. March 10, 2021

This presentation contains certain statements, estimates and forecasts with respect to future performance

and events. These statements, estimates and forecasts are “forward-looking statements” that involve risks and uncertainties. In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “may,”

“might,” “should,” “expect,” “plan,” “intend,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue” or the negatives thereof or variations thereon or similar terminology. Any statements other than statements of historical

fact included in this presentation are forward-looking statements and are based on various underlying assumptions and expectations and are subject to known and unknown risks, uncertainties and assumptions and may include projections of our

future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events, including the impacts of, and

associated responses to: the Covid-19 pandemic; our ability to consummate the proposed transaction; our ability to obtain requisite regulatory and shareholder approval and the satisfaction of other conditions to the consummation of the proposed

transaction; our ability to successfully integrate GECAS’ operations and employees and realize anticipated synergies and cost savings; and the potential impact of the announcement or consummation of the proposed transaction on relationships,

including with employees, suppliers, customers and competitors.. There are important factors, that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity,

performance or achievements expressed or implied in the forward-looking statements. As a result, we cannot assure you that the forward-looking statements included in this presentation will prove to be accurate or correct. Further information

regarding these and other risks is included in AerCap’s annual report on Form 20-F and other filings with the United States Securities and Exchange Commission. In light of these risks, uncertainties and assumptions, the future performance or

events described in the forward-looking statements in this presentation might not occur.Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and we do not assume any responsibility for the accuracy

or completeness of any of these forward-looking statements. Except as required by applicable law, we do not undertake any obligation to, and will not, update any forward-looking statements, whether as a result of new information, future events

or otherwise.No warranty or representation is given concerning such information, which must not be taken as establishing any contractual or other commitment binding upon AerCap Holdings N.V. or any of its subsidiaries or associated companies.In

addition to presenting financial results in conformity with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP financial measures. Reconciliations of such non-GAAP financial measures are set

forth or referred to in the presentation where relevant. Non- GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP.Due to rounding, numbers

presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. Disclaimer Including Forward Looking Statements & Safe Harbor © AerCap | Confidential

property of the company, not for disclosure or use without permission 2

Transaction Summary AerCap will acquire GE Capital Aviation Services (“GECAS”)from General

Electric (“GE”) for total consideration of (a) 111.5 million AerCap ordinary shares, (b) $24 billion of cash and (c) $1 billion of AerCap notes and/or cashPost-transaction, GE will own ~46% of AerCap and hold twopositions on the AerCap Board of

DirectorsCiti and Goldman Sachs have provided a $24 billion committed financing facilityAerCap expects to maintain Investment Grade credit ratings withall three rating agencies © AerCap | Confidential property of the company, not

for disclosure or use without permission 3

Transaction Highlights Creates an industry leader across all areas of

aviation leasing:aircraft, engines and helicoptersCombines two complementary aircraft fleets focused onnarrowbody and new technology aircraftCombined company will have stronger revenues, cash flowsand earnings and greater customer

diversificationEnhances many of AerCap’s key credit metrics andmaintains its current investment grade ratingsFourth platform acquisition at a discount to book value,continuing AerCap’s strong track record of capital

allocation © AerCap | Confidential property of the company, not for disclosure or use without permission 4

Creating a Leader Across Aviation Leasing Combined company will be a leader in aviation

leasing>2,000 owned and managed aircraft across ~200 customers>900 owned and managed engines across ~45 customers>300 owned helicopters across ~40 customersHigh-quality combined aircraft fleet, with average fleet age of 6.9 years and

average remaining lease term of 7.1 yearsWorld’s premier engine leasing business will add further revenue diversification benefits and a wider product offeringEngine leasing fleet concentrated in CFM56 and LEAP engines that power the world’s

most popular aircraft (~5% of assets)Helicopter business is the youngest and largest fleet in the industry, and will be marked down significantly (~5% of assets) Highlights Combined Company Aircraft by NBV1 Current Technology Aircraft

44% New Technology Aircraft 56% Widebody 40% RJ, 1% Attractive portfolio focused on new technology and narrowbody aircraft assets New Technology Aircraft~75% Current Technology Aircraft~25% Dec 2020 Dec

2024 NarrowbodyNarrowbody ~66%59% © AerCap | Confidential property of the company, not for disclosure or use without permission 5 Widebody~33% RJ, <1% 1. As of December 31, 2020 and 2024 respectively. NBV % based on pro forma

estimates

Date Announced Acquiror Target Deal Value ($ bn) Jun.

2005 2.8 Sept. 2009 1.3 Dec. 2013 28.1 Mar. 2021 ~30 Continuation of Successful M&A Strategy AerCap has grown through three significant acquisitions: debis AirFinance in 2005, Genesis Lease in 2009 and ILFC in

2013AerCap can draw on this successful track record of completing large scale integrationImportantly, GECAS has built its fleet through disciplined organic growth, not overpriced M&A This will be AerCap’s fourth acquisition at a

discount to book value © AerCap | Confidential property of the company, not for disclosure or use without permission 6

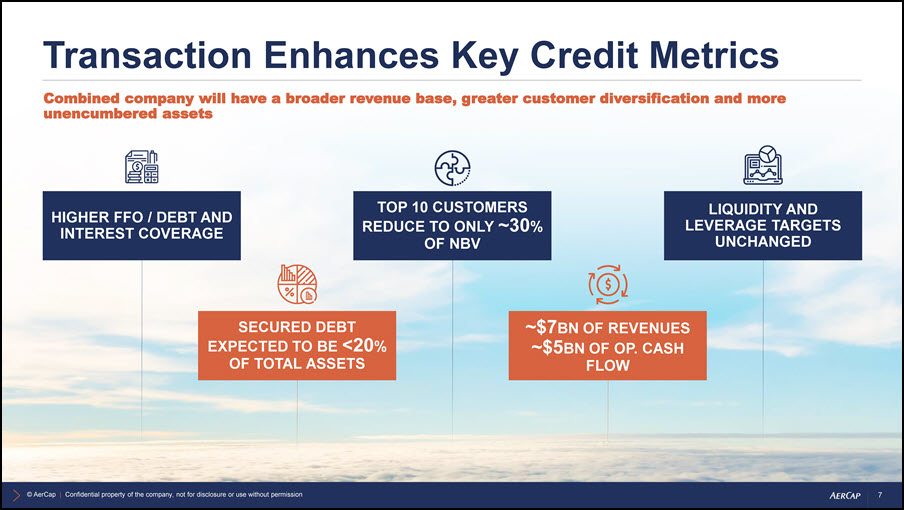

Transaction Enhances Key Credit Metrics ~$7BN OF REVENUES~$5BN OF OP. CASH FLOW LIQUIDITY AND LEVERAGE

TARGETS UNCHANGED SECURED DEBT EXPECTED TO BE <20% OF TOTAL ASSETS HIGHER FFO / DEBT ANDINTEREST COVERAGE TOP 10 CUSTOMERS REDUCE TO ONLY ~30% OF NBV Combined company will have a broader revenue base, greater customer diversification

and more unencumbered assets © AerCap | Confidential property of the company, not for disclosure or use without permission 7

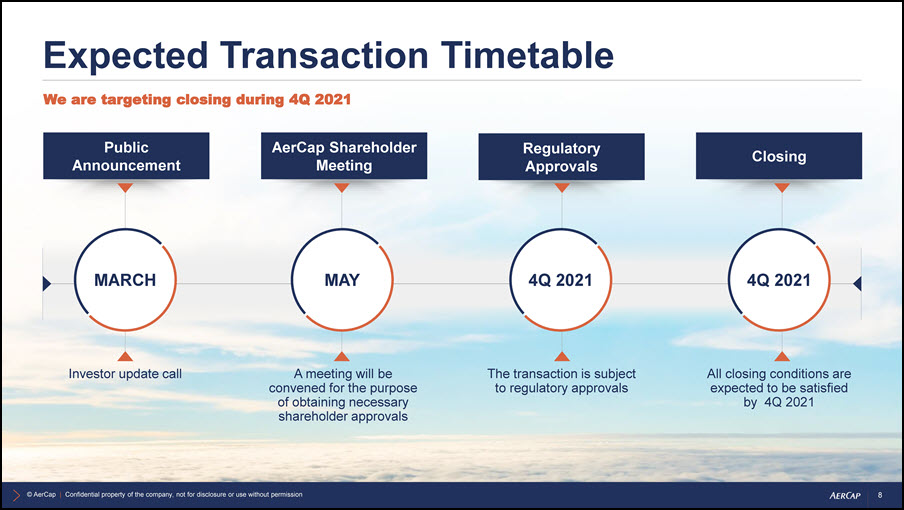

Expected Transaction Timetable Closing AerCap Shareholder

Meeting Public Announcement We are targeting closing during 4Q 2021 MARCH Regulatory Approvals Investor update call A meeting will be convened for the purpose of obtaining necessary shareholder approvals The transaction is

subjectto regulatory approvals All closing conditions are expected to be satisfied by 4Q 2021 M AY 4Q 2021 4Q 2021 © AerCap | Confidential property of the company, not for disclosure or use without permission 8

AerCap House65 St Stephens GreenDublin D02 YX20 Ireland T: +353 1 819 2010E: contact@aercap.com W:

aercap.com D u b l i n | S h a n n o n | L o s A n g e l e s | S i n g a p o r e | A m s t e r d a m | S h a n g h a i | A b u D h a b i | S e a t t l e | T o u l o u s e