Exhibit 10.8

Execution Text

|

|

DATED

|

2005

|

|

|

|

|

|

|

(1)

|

|

AERCAP IRELANDLIMITED

|

|

|

|

|

|

|

|

(2)

|

|

INTERNATIONAL CARGO

AIRLINES COMPANY KSC (trading as “LoadAir”)

|

|

|

|

|

|

|

|

(3)

|

|

AERVENTURE LIMITED

|

JOINT VENTURE

AGREEMENT

McCann FitzGerald

Solicitors

2 Harbourmaster Place

International Financial Services Centre

Dublin 1

CONTENTS

|

Clause

|

|

|

Page

|

|

|

|

|

|

|

|

|

1.

|

Interpretation

|

|

1

|

|

|

|

|

|

|

|

|

2.

|

Object of the Company

|

|

10

|

|

|

|

|

|

|

|

|

3.

|

Loan Contributions

|

|

11

|

|

|

|

|

|

|

|

|

4.

|

Conditions

|

|

12

|

|

|

|

|

|

|

|

|

5.

|

Completion

|

|

13

|

|

|

|

|

|

|

|

|

6.

|

Directors

|

|

13

|

|

|

|

|

|

|

|

|

7.

|

AerCap Warranties

|

|

15

|

|

|

|

|

|

|

|

|

8.

|

Provision of information to the

Shareholders

|

|

18

|

|

|

|

|

|

|

|

|

9.

|

Conduct of the Company’s affairs

|

|

19

|

|

|

|

|

|

|

|

|

10.

|

Business Plan

|

|

21

|

|

|

|

|

|

|

|

|

11.

|

Staff

|

|

22

|

|

|

|

|

|

|

|

|

12.

|

Dividend policy

|

|

22

|

|

|

|

|

|

|

|

|

13.

|

Financing of the Company

|

|

23

|

|

|

|

|

|

|

|

|

14.

|

Distressed Aircraft

|

|

24

|

|

|

|

|

|

|

|

|

15.

|

Issues and Transfers of Shares

|

|

26

|

|

|

|

|

|

|

|

|

16.

|

Default

|

|

30

|

|

|

|

|

|

|

|

|

17.

|

Deadlock

|

|

30

|

|

|

|

|

|

|

|

|

18.

|

Facilitation Fee

|

|

33

|

|

|

|

|

|

|

|

|

19.

|

Termination

|

|

34

|

|

|

|

|

|

|

|

|

20.

|

Confidential Information

|

|

34

|

|

|

|

|

|

|

|

|

21.

|

Costs

|

|

35

|

|

|

|

|

|

|

|

|

22.

|

Shareholders’ consents and enforcement

|

|

36

|

|

|

|

|

|

|

|

|

23.

|

Continuing obligations

|

|

36

|

|

|

|

|

|

|

|

|

24.

|

Acknowledgements

|

|

36

|

|

|

25.

|

Announcements

|

|

36

|

|

|

|

|

|

|

|

|

26.

|

Communications

|

|

37

|

|

|

|

|

|

|

|

|

27.

|

Assignment of Agreement

|

|

38

|

|

|

|

|

|

|

|

|

28.

|

General

|

|

40

|

|

|

|

|

|

|

|

|

29.

|

Governing law and jurisdiction

|

|

41

|

|

|

|

|

|

|

|

|

SCHEDULE 1

|

|

43

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

43

|

|

|

|

|

|

|

|

|

SCHEDULE 2

|

|

44

|

|

|

|

|

|

|

|

|

BUSINESS TO BE TRANSACTED AT COMPLETION

|

|

44

|

|

|

|

|

|

|

|

|

SCHEDULE 3

|

|

46

|

|

|

|

|

|

|

|

|

AERCAP WARRANTIES

|

|

46

|

|

|

|

|

|

|

|

|

SCHEDULE 4

|

|

47

|

|

|

|

|

|

|

|

|

RESTRICTED TRANSACTIONS

|

|

47

|

|

|

|

|

|

|

|

|

SCHEDULE 5

|

|

51

|

|

|

|

|

|

|

|

|

PART 1 DEED OF ADHERENCE

|

|

51

|

|

|

|

|

|

|

|

|

SCHEDULE 5

|

|

53

|

|

|

|

|

|

|

|

|

PART 2 DEED OF ADHERENCE FOR NOMINATED

PARTY

|

|

53

|

|

|

|

|

|

|

|

|

SCHEDULE 6

|

|

55

|

|

|

|

|

|

|

|

|

SHAREHOLDER’S WRITTEN RESOLUTIONS

|

|

55

|

|

|

|

|

|

|

|

|

SCHEDULE 7

|

|

57

|

|

|

|

|

|

|

|

|

EQUITY DRAWDOWN SCHEDULE

|

|

57

|

|

AGREED

FORM DOCUMENTS

Administrative

Agency Agreement

Articles

Cash

Management Agreement

Servicing

Agreement

ANNEXED DOCUMENT

Aircraft

Letter of Intent

|

THIS AGREEMENT is made on

|

|

2005

|

BETWEEN:

(1) AERCAP IRELAND

LIMITED, a

company incorporated in Ireland (registered no. 51950), whose registered office

is at debis AirFinance House, Shannon, Co. Clare, (“AerCap”);

(2) INTERNATIONAL CARGO AIRLINES COMPANY KSC (trading as “LoadAir”), a company incorporated in Kuwait,

registered no.109323 whose principal place of business is at Kuwait Free Trade

Zone, Moevenpick Way, Kuwait City, P.O. Box 42433 Postal Code 70655 (“LoadAir”); and

(4) AERVENTURE LIMITED, a company incorporated in Ireland (registered no. 410443) whose

registered office is at debis AirFinance House, Shannon, Co. Clare (the “Company”).

RECITALS:

(A) The Company was incorporated on 7 November 2005 under the Companies

Acts 1963 to 2005 and is a private company limited by shares.

(B) The Company has an authorised share capital of €100,000 divided into

100,000 ordinary shares of €1 one of which has been issued or allotted and is

fully paid. Such share is currently held

by AerCap.

(C) AerCap and LoadAir have agreed that the Company shall be a joint

venture vehicle for the purpose of the acquisition and leasing of a fleet of

new Airbus aircraft as described in this Agreement. AerCap and LoadAir wish to

participate as shareholders in the Company in order to facilitate the

achievement of this purpose on the terms set out in this Agreement.

(D) AerCap and LoadAir have further agreed that the Company shall enter

into certain services agreements described in this Agreement with AerCap and

certain members of the AerCap Group, being services described in the Servicing

Agreement, the Administrative Agency Agreement and the Cash Management

Agreement.

(E) This Agreement contains the terms upon which AerCap and LoadAir have

agreed to invest in the Company and provisions governing the operation of the

Company.

NOW IT IS AGREED as follows:

1. Interpretation

1.1 Unless the context otherwise requires each of the following words

and expressions shall have the following meanings:

“acting in concert”

has the meaning set out in section 1(3) of the Irish Takeover Panel Act, 1997;

“Additional AerCap Loan Contribution” means the non-interest

bearing loan of US$18,000,000 made by AerCap to the Company on the date hereof

pursuant to

1

Clause

3.2 for the purposes described in that Clause and to be capitalised by the

issue of Shares at Completion;

“Additional Aircraft” means any aircraft from time to time

and at any time owned by a member of the Group other than the Initial Aircraft;

“Additional Shareholder Capital” means the nominal value of

any Shares subscribed for pursuant to Clause 13.4;

“Additional Shareholder Capital Tranche” means in respect of

a Financing Start Date:

(a) the sum of:

(i) the amount scheduled in the Equity Drawdown Schedule to be subscribed

for in Shares (in cash at par) in the Relevant Quarter or such other amount (not

being more than 115% of the scheduled amount) as the Cash Manager may

determine; and

(ii) any amount or amounts scheduled in the Equity Drawdown Schedule to

be subscribed for in Shares (in cash at par) in the quarter immediately before

or after the Relevant Quarter as the Cash Manager may determine provided that

such amount(s) have not already been subscribed for pursuant to Clause 13.4 and

the Cash Manager has confirmed to the Shareholders that such amount(s) are required

to be postponed or brought forward as a result of any deferral or acceleration

of the relevant payments under the Aircraft Purchase Agreement,

less any

amount scheduled in the Equity Drawdown Schedule to be subscribed for in Shares

(in cash at par) in the Relevant Quarter which has already been subscribed for

pursuant to Clause 13.4 in accordance with paragraph (ii) above; or

(b) such greater amount as the Board may approve with the consent of the

Significant Shareholders.

“Administrative Agency Agreement” means the agreement to be

entered into between the Company and the Administrative Agent in the agreed

form and comprising one of the Services Agreements;

“Administrative Agent” means AerCap Administrative Services

Limited;

“AerCap Group” means the Shareholder Group of AerCap;

“AerCap Warranties” means the warranties contained in

Schedule 3 and “AerCap Warranty” means any such

warranty;

“Agreed Proportion” means, in respect of a

Shareholder:

(a) where the term is used in Clauses 13.4, 15.1 and 15.5(c), the

percentage which the nominal value of the Shares beneficially owned by that

Shareholder at the relevant time bears to the aggregate nominal value of all

the issued Shares

2

from time to

time (excluding any Defaulting Shares as defined in Article 17.3); and

(b) where the term is used in any other provision of this Agreement, the

percentage which the nominal value of the Shares beneficially owned by that

Shareholder at the relevant time bears to the aggregate nominal value of all

the issued Shares from time to time;

“Airbus” means Airbus SAS;

“Airbus Confidential Information” means any information

subject to obligations of confidentiality in favour of Airbus under the

Aircraft Letter of Intent or Airbus Purchase Agreement;

“Aircraft” means Initial Aircraft and Additional Aircraft;

“Aircraft Letter of Intent” means the letter of intent dated

23 November 2005 made between Airbus, the Company, and AerCap BV in respect of

the Initial Aircraft, a copy of which is annexed hereto and initialled by the

parties for the purposes of identification;

“Aircraft Purchase Agreement” means the agreement to be

entered into between Airbus and the Company on the date of this Agreement inter

alia for the purchase by the Company of the Initial Aircraft;

“Articles” means the articles of association

of the Company in the agreed form to be adopted prior to Completion pursuant to

the special resolutions set out in Schedule 6 (and as amended from time to

time) and any reference in this Agreement to any Article shall be to that

article of the Articles;

“Auditors” means the auditors of the Company

for the time being;

“Board” means the board of Directors;

“Budget” means the first annual operating budget of the

Company to be agreed at the first Board meeting of the Company after Completion

based on an expansion in monthly format of the Model;

“Business” has the meaning set out in Clause

2.1;

“Business Day” means a day other than a

Saturday or Sunday in Ireland on which banks are generally open for business in

both Dublin and Kuwait;

“Business Plan” means, at the date of this

Agreement, the Model and (when agreed) the Budget and, at any subsequent date,

the most recent business plan of the Group containing the reports and other

material referred to in Clause 10.5 and approved in accordance with Clause 10;

“Call Notice” has the meaning set out in Clause 13.4;

3

“Cash Management Agreement” means the agreement to be entered

into between the Company and the Cash Manager in the agreed form and comprising

one of the Services Agreements;

“Cash Manager” means AerCap Cash Manager II Limited;

“Chairman” means the chairman of the Board

for the time being;

“Completion” means completion of the matters

provided for in Clause 5 and Schedule 2 in accordance with that Clause and

Schedule;

“Completion Date” means the date upon which

Completion takes place;

“Companies Acts” means the Companies Acts

1963 to 2005 and any legislation in whatever form to be construed as one with

those Acts;

“Condition Date” means in respect of a Condition, the date and

time specified in that Condition;

“Conditions” means the conditions set out in

Clause 4.1 (a) and (b) and “Condition” means one such condition;

“Confidential Information” means:

(a) any information, data, facts, intelligence and/or material relating

to the Group and/or the Business;

(b) any information, data, facts, intelligence and/or material relating

to this Agreement and/or any document referred to in this Agreement; and

(c) such information, data, facts, intelligence and/or material as a

Shareholder may from time to time provide to any other Shareholder, whether

orally or in writing, regarding the structure, business, assets, liabilities,

operations, budgets and strategies of the first-mentioned Shareholder or its

Shareholder Group;

“connected with”, in relation to two or more

persons, means two or more persons who are connected with each other for the

purposes of section 10 of the Taxes Consolidation Act 1997 and a “Connected Person” of any person means a

person who is connected with that first-mentioned person;

“Deed of Adherence” means a deed in the form

set out in Part 1 of Schedule 5;

“Deposit Loan” means the non-interest bearing loan of

US$7,000,000 made to the Company by AerCap for the purposes of paying the

partly non-refundable deposit of the same sum to Airbus pursuant to the Aircraft Letter of Intent and

to be capitalised by the issue of Shares at Completion;

“Director” means a director of the Company

for the time being;

“Draft Business Plan Date” in respect of a draft Business Plan means 15

October in the year before the start of the financial year to which the draft

Business Plan relates,

4

save

in the case of the draft Business Plan for the year to 31 December 2007, in

respect of which the Draft Business Plan Date shall be 31 July 2006;

“Eligible Bank” means a bank which is acceptable to Airbus in

Airbus’ sole discretion;

“Encumbrance”

includes any adverse claim or right or third party right or interest, any

equity, any option or right of pre-emption or right to acquire or restrict, any

mortgage, charge, assignment, hypothecation, pledge, lien or security interest

or arrangement of whatsoever nature, any reservation of title, and any other

encumbrance, priority or security interest or similar arrangement of whatever

nature;

“Equity Drawdown Schedule”

means the equity drawdown schedule of the Company contained in Schedule 7;

“euro” and “€”

mean the lawful currency of Ireland;

“Event of Default” means in relation to a

Shareholder (other than AerCap in the case of paragraph (c) below) the

occurrence of any of the following:

(a) that Shareholder fails to make on the due date any payment to the

Company which it is required by the Cash Manager to make pursuant to Clause 13

or to deliver the Initial Shareholder Capital Security in accordance with Clause

13.2 provided that if by the Scheduled Date (as defined in Clause 13.3) the

Cash Manager has received the Initial Call Amount (as defined in Clause 13.3) payable

by a Shareholder pursuant to an exercise of the Initial Shareholder Capital

Security in relation to that Shareholder, that Shareholder shall not be deemed

to have failed to make payment of that Initial Call Amount for the purposes of

this paragraph (a); or

(b) an Insolvency Event occurring in relation to that Shareholder; or

(c) a Relevant Change in Control of that Shareholder without the consent

of the Significant Shareholders;

“Fair Value” in respect of any Shares, means

the fair value of those Shares as determined in accordance with Article 16;

“Financing Event of Default” means an Event of Default of the

type described in paragraph (a) of the definition of that term;

“Financing Start Date” means the date 45 days before the first date of a quarter

as set out in the Equity Drawdown Schedule which shall be the “Relevant Quarter” in respect of that Financing Start Date;

“Group”

means the Company and its subsidiary undertakings from time to time (if any),

or any of them, as the context requires and “member

of the Group” shall have a corresponding meaning;

“Initial Aircraft” shall mean all of the Aircraft as defined in

the Aircraft Purchase Agreement;

5

“Initial Shareholder Capital” means US$100,000,000, comprising the Loan Contributions and the

Secured Initial Shareholder Capital;

“Initial Shareholder Capital Security” means:

(a) in relation to LoadAir or any person to whom LoadAir

or (save in the case of a Related Holder) AerCap has transferred Shares (a “Relevant Shareholder”) an irrevocable, standby letter of

credit or other irrevocable financial instrument issued by an Eligible Bank in favour of the Company (and exercisable on behalf of

the Company by the Cash Manager in accordance with Clause 13.3) or such other

form of security in favour of the Company (and exercisable on behalf of the

Company by the Cash Manager in accordance with Clause 13.3) as may be

acceptable to Airbus in Airbus’ sole discretion in each case in a form

acceptable to Airbus in Airbus’ sole discretion and on terms that secure

payment by the Relevant Shareholder of the Agreed Proportion of the Secured

Initial Shareholder Capital (based on shareholdings at the Security Delivery

Date) pursuant to Clause 13.3,

(b) in relation to AerCap (or

any Related holder of AerCap) a guarantee of AerCap B.V. acceptable to Airbus issued

in favour of the Company (and exercisable on behalf of

the Company by the Cash Manager in accordance with Clause 13.3) on terms that secure

payment by AerCap of the Agreed Proportion of the Secured Initial Shareholder

Capital (based on shareholdings at the Security Delivery Date) pursuant to

Clause 13.3

in each case to be delivered pursuant to Clause 13.2.

“Insolvency

Event” means, in relation to a Shareholder:-

(a) any distress, execution, sequestration or other process being levied

or enforced upon or sued out against the property of the Shareholder which is

not discharged within 10 Business Days; or

(b) the inability of the Shareholder to pay its debts in accordance with

Section 214 of the Companies Act 1963 or any equivalent provision of any

applicable law;

(c) the Shareholder ceasing or threatening to cease wholly or

substantially to carry on its business, otherwise than for the purpose of a

reconstruction or amalgamation without insolvency previously approved by the

other Shareholders, (such approval not to be unreasonably withheld); or

(d) any encumbrancer taking possession of or a receiver or trustee being

appointed over the whole or any part of the undertaking, property or assets of

the Shareholder; or

(e) the making of an order or the passing of a resolution for the

winding up of the Shareholder, otherwise than for the purpose of a reconstruction

or amalgamation without insolvency previously approved by the other Shareholder

(such approval not to be unreasonably withheld); or

6

(f) any analogous event occurring in any jurisdiction in respect of the

Shareholder;

“Insurance Servicer” means AerCap Cash Manager II Limited;

“Ireland” means the Republic of Ireland;

“LoadAir Group” means the Shareholder Group

of LoadAir;

“LoadAir Loan Contribution” means the non-interest bearing

loan of US$25,000,000 made by LoadAir to the Company on the date hereof pursuant

to Clause 3.1 for the purposes described in that Clause and to be capitalised

by the issue of Shares at Completion;

“Loan Contributions” means the Deposit Loan, the Additional AerCap

Loan Contribution and the LoadAir Loan Contribution;

“Model” means the cashflow and financial projections for the

Company covering the period from 2006 to 2014 as reviewed by KPMG and

subsequently amended by mutual agreement as at the date hereof;

“Nominated Company” has the meaning given to it in Clause 27.2;

“Original holder” means a person who acquires Subscription Shares

pursuant to paragraph (d) of Schedule 2 being AerCap or LoadAir as the case may

be;

“Permitted Transferee” in relation to a

Shareholder, means any person or persons to whom Shares formerly held by such Shareholder

have been transferred (whether or not by such Shareholder) and held pursuant to

Article 14.1 or Article 14.4;

“quarters” means consecutive three monthly periods ending on

31 March, 30 June, 30 September and 31 December in any year;

“Related Company” has the meaning given to it in the

Articles;

“Related holders” means in respect of an Original holder any person

holding Shares as a nominee of the Original holder pursuant to a transfer

pursuant to Article 14.4 and any person holding Shares as a Related Company of

the Original holder pursuant to a transfer pursuant to Article 14.1;

“Relevant Change in

Control” shall be deemed to occur in relation to a Shareholder

(other than AerCap) if any person or persons connected with each other or

persons acting in concert with each other, any one or more of which (other than

LoadAir) is an international aircraft operating lessor, obtains control over

the Shareholder. For this purpose, “control”

has the meaning given by section 432 of the Taxes Consolidation Act 1997;

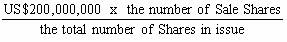

“Relevant Number of Votes” in respect of a Director means a

number of votes equal to A where A is calculated as follows:

|

A

|

|

=

|

|

|

7

where:

|

B

|

|

=

|

|

the

nominal value of the Shares beneficially owned by the Significant Shareholder

who appointed the Director;

|

|

|

|

|

|

|

|

C

|

|

=

|

|

the

number of Directors appointed by the Shareholder who appointed the Director

and who are present at the relevant meeting or whose alternate is present at

the relevant meeting,

|

in

each case at the time the number of votes is being determined;

“Secured Initial Shareholder Capital” means US$50,000,000 which

is to be contributed to the Company pursuant to Clause 13.3 and which is the

subject of the Initial Shareholder Capital Security;

“Security Delivery Date” means 31 January 2006 save with

respect to LoadAir if Airbus has declined to accept the guarantee from Al

Fawares as the Initial Shareholder Capital Security in respect of LoadAir in

which event the Security Delivery Date for LoadAir shall be the date which is

six weeks after such decision is advised by Airbus to LoadAir;

“Service Providers” means the Administrative Agent, the Cash

Manager and AerCap and the Insurance Servicer in their capacity as Servicers

under the Services Agreements;

“Services Agreements” means the

Administrative Agency Agreement, the Cash Management Agreement and the

Servicing Agreement;

“Servicing Agreement” means the agreement to be made between

the Company, AerCap, the Insurance Servicer, the Administrative Agent and the

Cash Manager in the agreed form and comprising one of the Services Agreements;

“Servicer” means AerCap acting as Servicer under the

Servicing Agreement;

“Shareholder” means a beneficial owner of

Shares and “Shareholders” means all such beneficial

owners from time to time and, upon the assignment of its interest by LoadAir to

the Nominated Company under Clause 27 below, shall include that Nominated

Company for so long as it continues to be a beneficial owner of Shares;

“Shareholder Capital” means the aggregate nominal value of

all Shares in issue from time to time;

“Shareholder Group” means, in respect of a Shareholder, that

Shareholder, its parent undertakings and subsidiary undertakings and any other

subsidiary undertakings of such parent undertakings, from time to time or any

of them as the context requires;

“Shares” means the ordinary shares in the

capital of the Company from time to time;

“Significant

Shareholder” means a Shareholder for the time being the beneficial owner of more

than 10% in nominal value of all the issued Shares from time to time;

8

“Subscription Shares” means the 50,000,000 Shares the subscription

for which by AerCap and LoadAir in equal proportions is provided for in Clause

5 and Schedule 2;

“Transfer Notice” has the meaning given to

it in the Articles;

“US$” means US dollars;

“Valuer” has the meaning given to it in the Articles; and

1.2 In this Agreement, unless the context requires otherwise:

(a) a reference to a “parent

undertaking” and “subsidiary

undertaking” is to be construed in accordance with the European

Communities (Companies: Group Accounts) Regulations, 1992;

(b) a reference to a document in the “agreed

form” is a reference to a document in a form approved and for the

purposes of identification signed by or on behalf of each party;

(c) a reference to a person (including a party to this Agreement)

includes a reference to that person’s legal personal representatives,

successors and permitted assigns;

(d) a reference to a document is a reference to that document as from

time to time supplemented or varied;

(e) any reference in this Agreement and/or in the Schedules to any statute

or statutory provision shall be deemed to include any statute or statutory

provision which amends, extends, consolidates, re-enacts or replaces same, or

which has been amended, extended, consolidated, re-enacted or replaced (whether

before or after the date of this Agreement) by same and shall include any

orders, regulations, instruments or other subordinate legislation made under

the relevant statute;

(f) words importing the singular shall include the plural number and

vice versa and words importing a gender shall include each gender;

(g) words and phrases the definitions of which are contained or referred

to in the Companies Acts shall be construed as having the meanings thereby

attributed to them;

(h) any reference to any Clause, sub-Clause, paragraph, Schedule or

Appendix shall be a reference to the Clause, sub-Clause, paragraph, Schedule or

Appendix of this Agreement in which the reference occurs unless it is indicated

that reference to some other provision is intended;

(i) the provisions of the Schedules to this Agreement shall form an

integral part of this Agreement and shall have as full effect as if they were

incorporated in the body of this Agreement and the expressions “this Agreement” and “the Agreement” shall be deemed to include

the Schedules to this Agreement;

9

(j) any reference to a “person”

shall be construed as a reference to any individual, firm, company,

corporation, undertaking, government, state or agency of a state, or any association

or partnership (whether or not having separate legal personality);

(k) the headings contained in this Agreement and the Schedules are

inserted for convenience of reference only and shall not in any way form part

of nor affect nor be taken into account in the construction or interpretation

of any provisions of this Agreement or the said Schedules;

(l) all references in this Agreement to costs, charges and expenses

include any value added tax or similar tax charged or chargeable in respect

thereof;

(m) all references in this Agreement to “indemnify” and “indemnifying”

any person against any circumstance include indemnifying and keeping that

person harmless from all actions, claims and proceedings from time to time made

against that person and all loss or damage and all payments, costs or expenses

made or incurred by that person as a consequence of or which would not have

arisen but for that circumstance;

(n) references in this Agreement to a “company”

shall be construed so as to include any company, corporation or body corporate,

whenever and however established or incorporated;

(o) the rule known as the ejusdem generis rule shall not apply to the

interpretation of this Agreement and accordingly general words, including those

introduced by “other” or followed

by “including” shall not be given

a restrictive meaning by reason of the fact that they are preceded by words

indicating a particular class of acts, matters or things and general words

shall not be given a restrictive meaning by reason of the fact that they are

followed by particular examples intended to be embraced by general words;

(p) any reference to an Irish legal term for any action, remedy, method

of judicial proceeding, legal document, legal status, court, official or any

legal concept or thing shall, in respect of any jurisdiction other than

Ireland, be deemed to include a reference to what most nearly approximates in

that jurisdiction to the Irish legal term;

(q) a reference to the “other Shareholders” or any of them shall include

a reference to the “other Shareholder” if there shall be only two Shareholders

at the relevant time; and

(r) if a payment would otherwise be required to be made on a day on

which banks are not generally open for business in New York the payment shall

be required to be made on the next following day which is a Business Day and on

which banks are generally open for business in New York.

2. Object of the Company

2.1 The primary object of the Company shall be to carry on the business

of acquiring, leasing, selling or otherwise disposing of the Aircraft (the “Business”).

10

2.2 The Business shall be conducted in the best interests of the Company

on sound commercial profit making

principles, so as to maximise the risk adjusted present value of the

cash flows over the life of the Aircraft from leasing and re-leasing or selling

or otherwise disposing of the Aircraft taking into account the then existing

and anticipated market conditions affecting the operating leasing of aircraft,

the commercial aviation industry generally and any contractual restrictions

imposed in any document executed in respect of the Aircraft and without

prejudice to the generality of the foregoing in a manner which has as its

objective, in so far as practicable, to:

(a) maximise the use of cost effective third party funding;

(b) lease the Aircraft on terms that optimise the balance between credit

risk, lease term and remuneration; and

(c) enable the portfolio of Aircraft to be actively traded at optimal

values to enable the Shareholders to realise their financial benefits from the transaction.

2.3 The central management and control of the Company shall be exercised

in Ireland and each of the Shareholders shall take such steps as are within its

control to ensure that the Company is treated by all relevant authorities as

being resident for taxation and other purposes in Ireland.

3. Loan Contributions

3.1 In consideration for AerCap and the Company agreeing to enter into

this Agreement LoadAir hereby pays to the Company the sum of US$25,000,000 on

the following basis:

(a) such amount comprises a non-interest bearing loan to the Company by LoadAir;

(b) the Company hereby directs LoadAir to pay or to procure the payment

of US$17,500,000 of such amount to Airbus on behalf of the Company and in part

satisfaction of the Company’s obligations under the Aircraft Purchase Agreement

to make a part payment of Predelivery Payments (as defined in the Aircraft

Purchase Agreement) under the Aircraft Purchase Agreement (in this Clause 3, the

“Aircraft Payments”); and

(c) if each Condition is not satisfied or waived on or before the

Condition Date the Company undertakes to repay the amount of US$25,000,000 to LoadAir

in the case of $7,500,000 thereof within 3 Business Days of the Condition Date

and in the case of US$17,500,000 thereof within 3 Business Days of the

repayment by Airbus to the Company of the Aircraft Payments.

3.2 In consideration for LoadAir and the Company agreeing to enter into

this Agreement, and in addition to the Deposit Loan, AerCap hereby pays to the

Company the sum of US$18,000,000 on the following basis:

(a) such amount and the Deposit Loan each comprises a non-interest

bearing loan to the Company by AerCap; and

11

(b) the Company hereby directs AerCap to pay or to procure the payment

of US$10,500,000 of such amount to Airbus on behalf of the Company and in part

satisfaction of the Company’s obligations under the Aircraft Purchase Agreement

to make the Aircraft Payments; and

(c) if each Condition is not satisfied or waived on or before the

Condition Date the Company undertakes to repay the amount of US$25,000,000 (comprising

the Deposit Loan and the Additional AerCap Loan Contribution) to AerCap in the

case of US$7,500,000 thereof within 3 Business Days of the Condition Date and

in the case of US$17,500,000 thereof within 3 Business Days of the repayment by

Airbus to the Company of the Aircraft Payments.

3.3 The Company shall use its best endeavours to procure that Airbus

repays to the Company any amount which falls due for repayment under Letter Agreement

No 14 to the Aircraft Purchase Agreement.

3.4 The Loan Contributions shall not be repayable otherwise than as

provided in Clause 3.1(c) and Clause 3.2(c).

3.5 On Completion the Loan Contributions shall be capitalised by way of

subscription for Shares as set out in Schedule 2.

4. Conditions

4.1 Except for Clauses 1, 3.1, 3.2

and 3.3, 4, 20, 21 and 25 to 29

(inclusive) this Agreement is conditional upon the following matters

having been fulfilled or having been waived in accordance with Clause 4.4:

(a) on or before 13 January 2006 (7pm CET) the conditions precedent to

the Aircraft Purchase Agreement having been satisfied in accordance with the

terms of the Aircraft Purchase Agreement; and

(b) on or before 13 January 2006 (7pm CET) the Company having obtained a committed offer

of a non-recourse borrowing facility from Calyon or another suitable provider

of such finance that has been approved by said financiers’ credit committee and

is subject only to documentation; such facility is to be of an amount that

would fund at least 60% of the cost of the pre-delivery payments (including

deposits) to be paid by the Company in respect of each of at least the first

twenty (20) of the Initial Aircraft, and otherwise on terms at least as

favourable to the Company as the following: an upfront fee of 1%, a margin of

1.1% and a commitment fee of the aggregate to 0.40% of the undrawn amount and

US$20,000 per annum.

4.2 AerCap undertakes to LoadAir that it will use all reasonable

endeavours to procure the satisfaction of each of the Conditions on or before

the Condition Date provided that if either Condition is not satisfied or waived

in accordance with Clause 4.4 before the Condition Date AerCap shall have no

obligation after that date to use reasonable endeavours to procure the

satisfaction of the other Condition.

4.3 If any Condition is not satisfied in full or waived in accordance

with Clause 4.4 on or before the Condition Date, then no Clause of this

Agreement other than this Clause 4

12

and those

Clauses referred to in Clause 4.1 will have any effect and no party shall have

any claim or liability to any other party, other than in respect of any breach

of those Clauses.

4.4 Each Condition may be waived with the agreement of AerCap and LoadAir

on or before the Condition Date.

4.5 AerCap undertakes to LoadAir that it shall procure that prior to

Completion the Company shall not carry out any material business or trading

activities or incur any material liability or obligation, save for any

activities described in paragraph 2.1 of Schedule 3 or any liability or

obligation described in paragraph 2.2 of Schedule 3 or any activities carried

on or any liability or obligation incurred in pursuance of any obligation of

the Company under this Agreement or the Aircraft Purchase Agreement or to

achieve satisfaction of the Conditions or which is the subject of an express provision

in the Budget, without the prior written consent of LoadAir.

5. Completion

5.1 Completion shall take place at the offices of McCann FitzGerald in

Dublin immediately following all of the Conditions having been satisfied or

waived (or at such other place or date as AerCap and LoadAir agree).

5.2 At Completion all, but not some only, of the actions set out in

Schedule 2 shall be taken (to the extent that they have not taken place prior

to Completion).

5.3 Subject to the Subscription Shares being allotted and issued in

accordance with paragraph (d) of Schedule 2, AerCap and LoadAir consent to

their names being entered in the register of members of the Company in respect

of the Subscription Shares to be subscribed for by them and agree that they

will take such Shares with the benefit of the rights and subject to the

restrictions set out in the Articles.

5.4 The parties consent to the subscriptions provided for in this Clause

5 and Schedule 2 and made pursuant to Clause 13 and waive or agree to procure

the waiver of any rights or restrictions which may exist in the Articles or

otherwise which might prevent any such subscriptions.

5.5 Subject to Clauses 4.3, 7.10 and 19 this Agreement shall not be

rescinded or terminated.

6. Directors

6.1 Subject to Clause 9.1(a) the Board shall have responsibility for the

supervision and management of the Company and its business.

6.2 For so long as each Shareholder beneficially owns the percentage of

the issued Shares set out in column (1) below, it shall be entitled to appoint

up to the number of persons set out in column (2) below as Directors and to

remove from office any person so appointed and to appoint another person in his

place.

13

|

(1)

|

|

(2)

|

|

|

Percentage of issued Shares held

|

|

Number of Directors

|

|

|

|

|

|

|

|

Equal to or greater than 50%

|

|

4

|

|

|

|

|

|

|

|

Equal to or greater than 25% but less than

50%

|

|

2

|

|

|

|

|

|

|

|

Greater than 10% but less than 25%

|

|

1

|

|

|

|

|

|

|

|

Equal to or less than 10%

|

|

None

|

|

6.3 Each Shareholder agrees with the other parties that if at any time the

percentage of the issued Shares which it beneficially owns is reduced (by

whatever means) such that the number of Directors which it is entitled to

appoint under Clause 6.2 is thereby reduced, it shall forthwith upon such

reduction procure the removal of such number of Directors appointed by it as is

necessary to reflect this reduction. If any Shareholder fails immediately to

procure the removal of a Director(s) as required under this Clause 6.3, the

office of such Director(s) shall be automatically vacated.

6.4 Any Director appointed by a Shareholder (or his alternate) voting on

a resolution at a meeting of Directors shall be deemed to exercise the Relevant

Number of Votes.

6.5 Each Significant Shareholder shall have the right exercisable

alternately for a period of one year of nominating one of the Directors to be

the Chairman of meetings of the Board and Shareholders and a Chairman so

appointed shall hold office as such until the termination of the next annual

general meeting following his appointment or (if earlier) the first day after

such appointment on which the Shareholder who has nominated such Chairman

ceases to be a Significant Shareholder.

6.6 Notwithstanding the generality of Clause 6.5, the first Chairman

shall be nominated by AerCap, and the second Chairman shall be nominated by LoadAir.

6.7 If the Chairman is unable to attend any meeting of the Board, then

the Shareholder who nominated him shall be entitled to appoint another Director

to act as chairman in his place at such meeting.

6.8 In the case of an equality of votes at any meeting of the Board the

Chairman shall not be entitled to a second or casting vote and the Chairman

shall not have a second or casting vote at any meeting of the Shareholders of

the Company.

6.9 Any appointment or removal pursuant to this Clause shall be made by

notice in writing served on the Company and the Company agrees to procure that

such appointment and/or removal shall be effected as soon as possible following

receipt of such notice.

6.10 Notwithstanding any provision of the Articles, each Director and

each person appointed to the board of directors of any subsidiary undertaking

of the Company shall be entitled to appoint any person to be an alternate

director, shall not be entitled to be paid any remuneration by any member of

the Group, shall not be required to hold any share qualification, shall not be

subject to retirement by rotation and shall

14

not be removed

except by the Shareholder which appointed him or pursuant to Clause 6.3 or

pursuant to Article 24.6(a), (c), (d), (e) or (g).

6.11 Each Director shall have the right to be appointed to any committee

or sub-committee of or established by the Board provided that this right may be

waived by that Director or any other Director appointed by the same Shareholder

on his behalf including by approving the establishment of such committee or

sub-committee.

6.12 Each Shareholder agrees with each of the parties that if it removes

a Director appointed by it in accordance with this Clause 6 or if any such

Director is removed pursuant to Clause 6.3 or Article 24.6 (a), (c), (d) (e) or

(g) it shall be responsible for, and shall indemnify the Company and the other

Shareholders against, any claims by such Director arising out of the Director’s

removal or loss of office. Each

Shareholder acknowledges that the Company shall not be obliged to procure any

insurance in respect of its Directors and officers.

6.13 A quorum for meetings of the Board shall comprise one Director

appointed by each Significant Shareholder or their duly appointed alternates

present in person, provided that if a quorum is not present the meeting shall

be adjourned to the same time and place fourteen days later when the Directors

present shall constitute a quorum.

6.14 A meeting of the Board shall, unless otherwise agreed by at least

one Director appointed by each of the Significant Shareholders, be called by notice in writing to all Directors of no

less than 14 days (exclusive of the date of service or deemed service and the

date of the meeting) or such lesser period as may be required to enable the

Company to give any instructions, directions, consent or response to the

Service Providers in accordance with the terms of the Servicing Agreements and

such notice shall specify the place, the day and the hour of the meeting, and

the nature of the business to be discussed thereat.

6.15 This Clause 6 shall apply to any subsidiary undertaking of the

Company mutatis mutandis provided that for such purposes the term “Shareholders”

shall continue to have the meaning set out in Clause 2.

7. AerCap Warranties

7.1 In consideration of LoadAir agreeing to enter into this Agreement,

AerCap warrants to LoadAir in the terms of the AerCap Warranties.

7.2 Immediately prior to Completion, AerCap shall be deemed to warrant

to LoadAir in the terms of the AerCap Warranties. For this purpose only, where

in an AerCap Warranty there is an express or implied reference to “the date of

this Agreement”, that reference is to be also construed as a reference to the “date

of Completion”.

7.3 Each of the AerCap Warranties is to be construed separately,

independently and without prejudice to any other AerCap Warranty and to any

matter expressly provided for under this Agreement but is otherwise subject to

no qualification whatever.

7.4 Subject to Clause 7.6, AerCap shall not be liable in respect of any

claim pursuant to the AerCap Warranties (a “Relevant

Claim”):

(a) if the amount of the Relevant Claim does not exceed US$500,000;

15

(b) unless the aggregate amount of all Relevant Claims for which AerCap

would otherwise be liable exceeds US$1,000,000 and in the event that the

aggregate amount exceeds US$1,000,000, AerCap shall be liable only for the

excess; or

(c) to the extent that the aggregate liability of AerCap in respect of

all Relevant Claims would exceed US$50,000,000.

7.5 Subject to Clause 7.6, AerCap shall be not liable in respect of a

Relevant Claim unless it has been given written notice of the Relevant Claim

(containing reasonable details of the grounds on which the Relevant Claim is

made) not later than 5 p.m. on the second anniversary of Completion. A Relevant

Claim so notified and not satisfied settled or withdrawn shall be unenforceable

against AerCap on the expiry of the period of nine months starting on the day

of such notification unless proceedings in respect of the Relevant Claim have

been issued and served on AerCap.

7.6 In the case of fraud by AerCap giving rise to a claim pursuant to

the AerCap Warranties its liability in respect of such claim shall not be

limited as set out in Clause 7.4 or Clause 7.5.

7.7 AerCap shall not be liable in respect of a Relevant Claim:

(a) to the extent that the matter giving rise to the Relevant Claim

would not have arisen but for an act, omission or transaction after Completion

by a member, director, employee or agent of any member of the LoadAir Group;

(b) to the extent that the matter giving rise to the Relevant Claim

would not have arisen but for the passing of, or a change in, after the date of

this Agreement a law, regulation or administrative practice of a government,

governmental department, agency or regulatory body, in each case not actually

or prospectively in force at the date of this Agreement;

(c) to the extent that the matter

giving rise to the Relevant Claim arises wholly or partially from an act,

omission or transaction before or after Completion at the written request or

with the written consent of a member of the LoadAir Group;

(d) to the extent that the matter giving rise to the Relevant Claim

would not have arisen but for any change in the rate of taxation and/or

practice of any relevant tax or revenue authority made after the Completion

Date with retroactive effect and not in force or announced as coming into force

at the date of this Agreement; or

(e) to the extent that the matter giving rise to the Relevant Claim is a

matter in respect of which a member of the LoadAir Group or the Company has recovered

any amount from a person other than AerCap whether under a provision of

applicable law, insurance policy or otherwise.

7.8 If AerCap pays to LoadAir an amount in respect of a Relevant Claim

and any member of the LoadAir Group or the Company (the “Recipient”)

subsequently recovers from another person an amount which relates to the matter

giving rise to the Relevant Claim:

16

(a) if the amount paid by AerCap in respect of the Relevant Claim is

equal to or more than the amount recovered, LoadAir shall immediately pay to

AerCap an amount equal to the sum recovered (less reasonable costs incurred by LoadAir

in recovering such amount); and

(b) if the amount paid by AerCap in respect of the Relevant Claim is

less than the amount recovered, LoadAir shall, within 10 Business Days of the

date of recovery pay to AerCap an amount equal to the amount paid by AerCap

(less reasonable costs incurred by the Recipient in recovering such amount).

7.9 AerCap undertakes to LoadAir that it will disclose forthwith (after

becoming aware of it) in writing to LoadAir any matter or thing which may arise

or become known to it after the date of this Agreement and before Completion

which would be inconsistent with any of the AerCap Warranties as if they were

repeated on Completion.

7.10 (a) If any of the AerCap Warranties is not or was not true, complete,

accurate in all material respects at the date of this Agreement or immediately

prior to Completion such that the aggregate liability of AerCap in respect of a

claim on foot of such breach would exceed US$50,000,000, LoadAir shall have a

right to terminate this Agreement. If LoadAir does not exercise this right,

each party shall proceed to Completion as far as is practicable but without

prejudice to its rights (whether under this Agreement, generally, or under this

clause).

(b) LoadAir shall not have the right to terminate this Agreement in the

event of any breach of the AerCap Warranties other than as provided in Clause

7.10(a).

(c) The rights and remedies of LoadAir in respect of a breach of any of

the AerCap Warranties shall not be affected:

(i) by Completion; or

(ii) by LoadAir terminating this Agreement pursuant to Clause 7.10(a),

except by a

specific and duly authorised written waiver or release by LoadAir.

7.11 Each Party warrants to each other Party that:

(a) it is validly incorporated with limited liability and is duly

incorporated or organised and validly existing under the applicable laws of its

jurisdiction of incorporation or organisation and has the power and all

necessary governmental and other consents, approvals, licences and authorities

under any applicable jurisdiction to own its material assets and carry on its

business substantially as it is conducted on the date of this Agreement;

(b) it has full power and authority to enter into and perform this

Agreement and any other agreements referred to in this Agreement to which it is

a party and no limits on its powers will be exceeded as a result of the taking

of any action contemplated by any such agreement;

(c) all actions, conditions and things required to be taken, fulfilled

and done (including the obtaining of any necessary consents and approvals), in

order to enable it lawfully to enter into, exercise its rights and perform and

comply

17

with its

obligations contained in this Agreement and any other agreements referred to in

this Agreement to which it is a party have been so taken, fulfilled or done and

the requisite resolutions of its board of directors have been duly and properly

passed at a duly convened and constituted meetings at which all statutory and

other relevant formalities were observed to authorise its execution and performance

of this Agreement and any other agreements referred to in this Agreement to

which it is a party and such resolutions are in full force and effect and have

not been varied or rescinded;

(d) when executed, this Agreement and any other agreements referred to

in this Agreement to which it is a party, will constitute legal, valid and

binding obligations on it in accordance with their terms; and

(e) neither the execution nor the delivery of this Agreement and any

other agreements referred to in this Agreement to which it is a party, nor the

carrying out of any transaction or the exercise of any rights or the

performance of any obligations contemplated by this Agreement and any other

agreements referred to in this Agreement to which it is a party will result

in:-

(i) violation of any law to which it is subject;

(ii) any breach of any of its constitutional documents;

(iii) any breach of any deed, agreement, instrument or obligation made

with or owed to any other person; or

(iv) any breach of any order, judgment or decree of any Court or

governmental agency to which it is a party or by which it is bound; and

(f) it is not involved in or engaged in any litigation, arbitration or

other legal proceedings of a litigious nature (whether as plaintiff, claimant

or defendant and whether civil, criminal or administrative) which is likely to

be adversely determined and, if adversely determined, would have an adverse

effect on its ability to perform its obligations under this Agreement and any

other agreements referred to in this Agreement to which it is a party.

7.12 No person to whom AerCap transfers or disposes of Shares shall have

any liability under or in respect of the AerCap Warranties whether under a Deed

of Adherence or otherwise.

8. Provision of information to the Shareholders

8.1 The Company shall supply the Shareholders with the following

information (in addition to the information referred to in Clause 10):

(a) the audited accounts of the Company and the audited consolidated

accounts of the Group for each financial year (together with copies of any

management letters produced by the Auditors in connection with the annual

audit) as soon as practical, and at the latest by four months after the end of

that financial year; and

18

(b) quarterly management accounts for the Group consisting of a balance

sheet, profit and loss account, cashflow statement and cashflow forecast for

the following three months together with a review of the relevant Business Plan,

a comparison against actual results and a summary of material contracts entered

into by the Group in that quarter as soon as practical, and at the latest by six

weeks after the end of each quarter.

8.2 Each Shareholder and each Director shall be entitled to examine the

books and accounts kept by each member of the Group during normal business

hours and on reasonable prior notice and shall be permitted to take and remove

copies of such books and accounts.

8.3 Each Director appointed by a Significant Shareholder shall be

entitled to exercise all rights of the Company under the Services Agreement to

make enquiries of and receive information from the Service Providers.

8.4 Each Shareholder and Director shall be entitled to have at all

reasonable times the facility of remote electronic access to the contract

management and other appropriate systems of the AerCap Group relating to the

Aircraft and the Business but only to the extent that those systems give access

to information relating solely to the Aircraft and the Business.

8.5 (a) Subject to Clause 8.5(b) a Director may pass any information

received from the Group or a party to the Services Agreement to a Shareholder

and a Shareholder may pass any information received from the Group or a

Director to:

(i) any member of the Shareholder Group;

(ii) any adviser to, trustee or manager of any member of the Shareholder

Group;

(iii) the Shareholder’s investment adviser and any of its other

professional advisers; and

(iv) any prospective purchaser of the Shares of the Shareholder or any investor

or prospective investor in any member of the Shareholder Group.

(b) No information which comprises Airbus Confidential Information shall

be disclosed to a person pursuant to Clause 8.5(a) unless that person shall

have entered in a confidentiality agreement with respect to such information

either with Airbus or, if Airbus so agrees, with the Company and in either case

in a form satisfactory to Airbus.

9. Conduct of the Company’s affairs

9.1 Each Shareholder undertakes to each other Shareholder that it shall

comply with its obligations under this Agreement and shall exercise all voting

rights and other powers of control available to it in relation to the Company

and the Directors or otherwise so as to procure (insofar as it is able by the

exercise of such rights and powers) that at all times during the term of this

Agreement:

19

(a) no member of the Group undertakes any matter referred to in Part A,

Part B or Part C of Schedule 4 unless the consent requirements in respect of

that matter specified to Schedule 4 have been satisfied;

(b) full effect is given to the terms and conditions of this Agreement;

(c) the business of the Group:

(i) consists exclusively of the Business;

(ii) is properly managed and carried on in an effective and businesslike

manner in accordance with Clause 2.2;

(iii) is carried on in compliance with all applicable laws;

(d) the operation, expansion and

development of the Business is controlled by the Company and that the Company

does not enter into any contract or transaction whereby the Business would or

might be controlled otherwise than by the Board;

(e) subject to the Services Agreements, each member of the Group keeps

books of account and makes true and complete entries in those books of all its

dealings and transactions of and in relation to its business and, where

applicable, the business of any other relevant member of the Group;

(f) each Shareholder is supplied with information and access in accordance

with Clause 8;

(g) each member of the Group complies with the provisions of its

memorandum and articles of association;

(h) at least 4 Board meetings are held each year and that, in any case,

the intervals between Board meetings shall not exceed 4 months;

(i) subject to Clause 6.12 each member of the Group is insured with an

insurer approved by the Insurance Servicer under the Servicing Agreement

against appropriate risks to the extent and in accordance with good commercial

practice in each case as recommended by the Insurance Servicer and remains so

insured at all times;

(j) no disposal of Shares is made or registered other than in compliance

with Clause 15 and the Articles, as applicable; and

(k) the Company is managed and controlled in Ireland and that all Board

meetings are held in Ireland.

9.2 Clause 9.1(a) shall have effect notwithstanding, and prevail over,

any other provision of this Agreement and, as between the Shareholders, any

provision of the Articles.

9.3 Neither the entry by any party

into, nor the performance by it of its obligations or the exercise by it of its

rights or entitlements under, the Services Agreements or any of them shall

constitute a breach of any term or provision of this Agreement.

20

9.4 To the extent to which it is able to do so by law, the Company

undertakes with each of the Shareholders that it will comply with each of the

provisions of this Agreement and that it will procure that no matter set out in

Part B or Part C of Schedule 4 occurs unless the consent requirements

applicable to that matter pursuant to Schedule 4 have been satisfied. Each

undertaking by the Company in respect of each provision of this Agreement shall

be construed as a separate undertaking and if any of the undertakings is

unlawful or unenforceable the remaining undertakings shall continue to bind the

Company.

10. Business Plan

10.1 No later than the Draft Business Plan Date the Company shall procure

that there shall be prepared in accordance with the Services Agreements and

delivered to the Board and each Shareholder a draft Business Plan for that

financial year which shall contain the information set out in Clause 10.5. Unless

the Board otherwise determines the financial year end of the Company shall be

31 December and if the financial year end of the Company is changed to a date

other than 31 December, the dates referred to in Clause 10.1 and 10.2 shall be

changed to permit the same period of time for consideration and approval of the

draft Business Plan.

10.2 Within 10 Business Days of receiving a draft Business Plan, or, if

later, the date (being no later than 30 November in the year before the start

of the financial year) on which each Director receives reasonably satisfactory

responses to any reasonable queries on the draft Business Plan which may have

been raised by the Board or any Director, the Board shall approve the draft Business

Plan subject to any amendment which it deems appropriate, whereupon it shall

become the Business Plan for the next financial year.

10.3 Any Director may exercise any rights of the Company pursuant to the

Services Agreement to seek clarification of any matter included in a draft Business

Plan.

10.4 The Board may make written changes to a Business Plan at any time

during the financial year to which that Business Plan relates and such changes

shall be dealt with in accordance with the Servicing Agreement.

10.5 The information to be contained in a draft Business Plan includes:

(a) a strategy paper recommending how to develop the current and future

aircraft portfolio of the Company in terms of additions, disposals and possible

deferrals in order to achieve the objectives of the Business;

(b) a marketing plan prepared by the Servicer showing the macro and micro

situation for the financial year to which the draft Business Plan relates in

detail and the following two years in prospect insofar as it will affect

placement of the Aircraft being delivered or in respect of which the leases are

due to terminate or expire during such period, together with a commentary on

the outlook for the Aircraft and any other relevant facts or analysis;

(c) a technical report covering macro and micro developments affecting

the portfolio Aircraft and future deliveries, including details of any

significant developments of the Airbus and competing narrowbody families, plus

any

21

widebody

market sectors in which current or future Aircraft types will compete;

(d) details of any actual or anticipated legal disputes involving a

Group Member as lessor and a Lease (as defined in the Servicing Agreement) and

the extent to which they are expected to affect the Aircraft and Business Plan

(net of insurance recoveries);

(e) the proposed budgets specified in Clause 7.3(d) of the Servicing

Agreement;

(f) a set of projected servicing fees for the applicable period,

together with a good faith estimate of the additional reimbursable expenses to

be charged to the Company;

(g) an update of the annual projected results for the Company’s

portfolio of Aircraft to 2014 (or to such other date as may be communicated by

the Company to the Administrative Agent by 1 July in the year before the start

of the relevant financial year) based on the Model whose assumptions shall have

been amended to reflect the latest anticipated market conditions and the

recommendations submitted to the Board by the Cash Manager; and

(h) such additional analysis, facts or data as the Service Providers in

their sole discretion consider the Board should consider or be aware of or

which the Board has requested the Service Providers to provide in accordance

with the Services Agreements.

11. Staff

The

Company shall have no staff.

12. Dividend policy

12.1 Subject to Clause 18, the Shareholder shall procure that the profits

of the Company available for distribution in accordance with law shall be

distributed to the maximum amount permissible by law provided that the Board

shall have formed the view that the payment of any such distribution can

reasonably be made having regard to the Company’s then current and prospective

obligations and in accordance with the Company’s obligations to third party

lenders.

12.2 The Shareholders shall procure that the Board shall not declare any

other dividend in respect of a Share before it has paid the Initial Dividend (including

any accrued Initial Dividend) in accordance with this Clause 12 provided that the

declaration of the Initial Dividend shall be subject to the restrictions and

considerations set out in Clause 12.1.

12.3 In Clause 12.2 the Initial Dividend shall mean an annual cumulative

dividend payable on a Share at the rate of 8% per annum of the nominal value of

that Share with effect from the date of issue of that Share.

12.4 Clause 12.1 shall apply to any subsidiary undertaking of the Company

mutatis mutandis, provided that for such purposes, the term “Shareholders”

shall mean the parent undertaking of such subsidiary undertaking.

22

13. Financing of the Company

13.1 The Shareholder Capital shall be applied by the Company in

accordance with the Business Plan.

13.2 Each Shareholder shall deliver the Initial Shareholder Capital

Security to the Company on or before the Security Delivery Date. AerCap will

use its reasonable endeavours to seek to persuade Airbus to accept a guarantee

from Al Fawares in suitable form as the Initial Shareholder Capital Security in

relation to LoadAir, it being accepted by each of AerCap and LoadAir that

Airbus may decide in its sole discretion not to accept such a guarantee for

such purposes.

13.3 (a) The Shareholders and the Company shall procure that on or before the

date by which any tranche of the Secured Initial Shareholder Capital is

scheduled in the Equity Drawdown Schedule to be contributed (the “Scheduled Date”):

(i) the Cash Manager shall:

(A) not less then 45 days before the Scheduled Date issue a notice in

writing requiring each Shareholder to pay to the Company the Agreed Proportion

of that tranche of the Secured Initial Shareholder Capital (the “Initial Call Amount”) by a date no more than 10 Business

Days before the Scheduled Date (the “Required Payment Date”);

and

(B) if any Shareholder fails to pay the Initial Call Amount by the Required

Payment Date, make a call on the Initial Shareholder Capital Security provided

by that Shareholder for the Initial Call Amount; and

(ii) on the later of the date of receipt of an Initial Call Amount by the

Company and the Scheduled Date, the Board shall issue to the Shareholder in

respect of which the Initial Call Amount has been paid, Shares fully paid at

par having a nominal value equal to the amount of that Initial Call Amount.

(b) In the event that:

(i) the Secured Initial Shareholder Capital is to be called in more than

one tranche pursuant to Clause 13.3(a); and

(ii) a Shareholder who has provided Third Party Security in respect of

its obligation to pay the Secured Initial Shareholder Capital pays the Initial

Call Amount in respect of that tranche and the Cash Manager is not required to

make a call on such Third Party Security in respect thereof,

the

Shareholder shall be entitled to reduce the amount to which such Third Party

Security relates by the amount of the Initial Call Amount.

13.4 (a) On any date on or before a Financing Start Date the Cash Manager

shall by notice in writing (the “Call Notice”)

require that each Shareholder shall pay to

23

the

Company no later than ten Business Days before the Relevant Quarter (the “Due Date”), the Agreed Proportion of the Additional

Shareholder Capital Tranche (the “Call Amount”)

provided that the Agreed Proportion shall be determined by reference to the

shareholdings in the Company as at the date of the Call Notice.

(b) Each Shareholder undertakes to each other Shareholder to pay the

Call Amount as set out in any such Call Notice in the manner specified in the

Call Notice.

(c) The Board shall issue to a Shareholder who pays a Call Amount,

Shares fully paid at par having a nominal value equal to the Call Amount.

(d) Each Shareholder shall provide to the Cash Manager no later than 30

Business Days prior to any quarter specified in the Equity Drawdown Schedule

proof that it has sufficient liquid funds or committed funding in an amount

sufficient to discharge the amount specified in the Call Notice.

13.5 The Shareholders shall ensure that the Company uses all reasonable

endeavours to procure that its requirements for capital to finance the Business

in excess of the Initial Shareholder Capital and the Additional Shareholder

Capital are met as far as practicable by borrowings on a non-recourse basis to

the Shareholders from banks, financial institutions and other customary sources

of aviation finance including the Export Credit Agencies. Such borrowings shall

be sought and obtained in accordance with the Cash Management Agreement.

13.6 Notwithstanding any other provision of this Clause 13, the

provisions of Clause 13 do not constitute any undertaking from any Shareholder

to the Company or the Group to provide the Additional Shareholder Capital or

any part thereof or any funds (other than the Initial Shareholder Capital) to

the Company or the Group or to give any guarantee, security, indemnity or other

support in respect of any of the liabilities or obligations of any member of

the Group.

14. Distressed Aircraft

14.1 The Company shall procure that the Servicer shall:

(a) notify each Shareholder if the Company becomes entitled under the

Aircraft Purchase Agreement to acquire a distressed aircraft (the “Distressed Aircraft”); and

(b) prepare and provide to each Shareholder a summary of the terms of

the proposed acquisition, a summary of the Distressed Aircraft specification

and a proposal for such changes to the Business Plan as appear to the Servicer

to be required in order for the Company to be able to acquire the Distressed

Aircraft (the “Business Plan Changes”)

in each case

within three Business Days of such entitlement arising.

14.2 AerCap shall provide to each other Shareholder full details of any

data procured or any analysis prepared by it for the purposes of its own

evaluation of any entitlement

24

which may accrue

to it pursuant to Clause 14.5(a) on the same day such details become available

to AerCap.

14.3 Provided that all Shareholders expressly approve the Business Plan Changes

within 6 Business Days of receipt of notification and the proposal for the

Business Plan Changes, the Company shall exercise the entitlement of the

Company to acquire the Distressed Aircraft.

14.4 The Shareholders shall within 10 Business Days from the date that

all Shareholders have approved the Business Plan Changes (or so much earlier as

the Business Plan Changes provide) provide any Additional Shareholder Capital

required pursuant to the Business Plan Changes in accordance with Clause 13

(mutatis mutandis) and for the avoidance of doubt a failure to provide such

Additional Shareholder Capital shall be a Financing Event of Default.

14.5 If any one or more Shareholders (“Declining

Shareholder”) shall not approve the Business Plan Changes within the

time limit set out in Clause 14.3 AerCap and LoadAir (provided that either of

them is not a Declining Shareholder) will enter into good faith negotiations

and use reasonable endeavours to agree terms on the basis of which they would

acquire the Distressed Aircraft together and if they fail to agree such terms:

(a) in the case of the first Distressed Aircraft to be considered under

this Clause 14, AerCap (provided that it was not a Declining Shareholder) shall

be entitled to acquire the Distressed Aircraft provided that if AerCap was a

Declining Shareholder or does not wish to exercise its entitlement as aforesaid

LoadAir shall be entitled to acquire the Distressed Aircraft; and

(b) in the case of the second Distressed Aircraft to be considered under

this Clause 14, LoadAir (provided that it was not a Declining Shareholder)

shall be entitled to acquire the Distressed Aircraft provided that if LoadAir

was a Declining Shareholder or does not wish to exercise its entitlement as

aforesaid AerCap shall be entitled to acquire the Distressed Aircraft; and

provided that

paragraph (a) shall apply to the third Distressed Aircraft to be considered

under this Clause 14 and paragraph (b) shall apply to the Fourth Distressed

Aircraft and so forth in sequence thereafter and in each case the Company will

procure that Airbus is notified in a timely fashion of the identity of the

acquirer of the Distressed Aircraft.

14.6 In the event that the exercise (the “Exercise”)

by a Shareholder of any rights under Clause 14.5 alone (“Sole

Reconfirmation Right”) or together with the acquisition by the

Company of a Distressed Aircraft and/or with exercise by another Shareholder of