As filed with the Securities and Exchange Commission on November 16, 2006.

Registration No. 333-138381

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

AERCAP HOLDINGS N.V.

(Exact name of Registrant as specified in its charter)

| Netherlands (State or other jurisdiction of incorporation or organization) |

7359 (Primary Standard Industrial Classification Code Number) |

Not Applicable (I.R.S. Employer Identification Number) |

Evert van de Beekstraat 312

1118 CX Schiphol Airport

The Netherlands

+31 20 655 9655

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

CT Corporation System, 111 Eighth Avenue, 13th Floor, New York, NY 10011, (212) 894-8641

(Name, address, including zip code, and telephone number, including area code, of agent for service of process)

| Copies to: | ||||

| Douglas A. Tanner, Esq. Milbank, Tweed, Hadley & McCloy LLP 1 Chase Manhattan Plaza New York, NY 10005 Tel: (212) 530-5000 Fax: (212) 822-5219 |

Erwin den Dikken Chief Legal Officer Evert van de Beekstraat 312 1118 CX Schiphol Airport The Netherlands Tel: + 31 20 655 9655 Fax: +31 20 655 9100 |

Richard J. Sandler, Esq. Davis Polk & Wardwell 450 Lexington Ave. New York, NY 10017 Tel: (212) 450-4224 Fax: (212) 450-3224 |

||

Approximate date of commencement of proposed sale to the public. As soon as practicable after the Registration Statement becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued November , 2006

26,100,000 Shares

AerCap Holdings N.V.

ORDINARY SHARES

AerCap Holdings N.V. and the selling shareholders are offering 26,100,000 ordinary shares, consisting of 6,800,000 ordinary shares offered by us and 19,300,000 ordinary shares being offered by the selling shareholders. This is an initial public offering of our ordinary shares. No public market currently exists for our ordinary shares. We will not receive any proceeds from the sale of ordinary shares by the selling shareholders. We expect the initial public offering price of our ordinary shares to be between $22.00 and $24.00 per share.

Our ordinary shares have been authorized for listing on the New York Stock Exchange under the symbol "AER".

Investing in our ordinary shares involves risks. See "Risk Factors" beginning on page 15 of this prospectus.

Price $ Per Share

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Us |

Proceeds to Selling Shareholders |

||||

|---|---|---|---|---|---|---|---|---|

| Per Ordinary Share | $ | $ | $ | $ | ||||

| Total | $ | $ | $ | $ |

The selling shareholders have granted the underwriters the right for a period of 30 days to purchase up to an additional 3,915,000 ordinary shares to cover over-allotments, if any.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to purchasers on , 2006.

| Morgan Stanley |

| Goldman, Sachs & Co. |

| Lehman Brothers |

| Merrill Lynch & Co. |

UBS Investment Bank

Wachovia Securities

JPMorgan

Citigroup

Calyon Securities (USA) Inc.

, 2006

| Prospectus Summary | 1 | |

| Risk Factors | 15 | |

| Special Note About Forward-Looking Statements | 38 | |

| Use of Proceeds | 39 | |

| Dividend Policy | 40 | |

| Dilution | 41 | |

| Capitalization | 42 | |

| Selected Consolidated Financial Data | 44 | |

| Unaudited Consolidated Pro Forma Financial Information | 51 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 78 | |

| Aircraft, Engine and Aviation Parts Industry | 116 | |

Business |

136 |

|

| Indebtedness | 160 | |

| Management | 169 | |

| Principal and Selling Shareholders | 180 | |

| Description of Ordinary Shares | 184 | |

| Certain Relationships and Related Party Transactions | 188 | |

| Ordinary Shares Eligible for Future Sale | 190 | |

| Tax Considerations | 192 | |

| Underwriters | 201 | |

| Enforcement of Civil Liabilities | 207 | |

| Legal Matters | 208 | |

| Experts | 208 | |

| Where You Can Find More Information | 208 | |

| Index to Financial Statements | F-1 |

This document may only be used where it is legal to offer or sell these securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of when this prospectus is delivered or when any offer or sale of our ordinary shares occurs.

Neither we nor the selling shareholders have taken any action to permit a public offering of the ordinary shares outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the ordinary shares and the distribution of this prospectus outside of the United States.

Until , all dealers that buy, sell or trade ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

The following summary is qualified in its entirety by the more detailed information and consolidated financial statements and related notes appearing in this prospectus. This summary may not contain all of the information that may be important to you. Before investing in our ordinary shares, you should read this entire prospectus carefully for a more complete understanding of our business and this offering, including our consolidated financial statements and related notes and the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations". In this prospectus, the "Company," "we," "us" and "our" refer to AerCap Holdings N.V., its consolidated subsidiaries, its predecessors, AerCap Holdings C.V. and AerCap B.V. (formerly known as debis AirFinance B.V.) and their consolidated subsidiaries and, unless the context otherwise requires, AeroTurbine, Inc.

Our Company

We are an integrated global aviation company with a leading market position in aircraft and engine leasing, trading and parts sales. We possess extensive aviation expertise that permits us to extract value from every stage of an aircraft's lifecycle across a broad range of aircraft and engine types. We also provide aircraft management services and perform aircraft and engine maintenance, repair and overhaul, or MRO, services and aircraft disassemblies through our certified repair stations. We believe that by applying our expertise through an integrated business model, we will be able to identify and execute on a broad range of market opportunities that we expect will generate attractive returns for our shareholders.

We operate our business on a global basis, providing aircraft, engines and parts to customers in every major geographical region. As of September 30, 2006, we owned 109 aircraft and 61 engines, managed 110 aircraft, had 79 new aircraft and six new engines on order, had entered into purchase contracts for 17 aircraft with GATX Financial Corporation and had executed letters of intent to purchase an additional nine aircraft. In addition, on October 17, 2006, we signed a letter of intent with Airbus S.A.S. to purchase 20 new A330-200 widebody aircraft. As of April 2006, we had the fifth largest aircraft leasing portfolio in the world and the third largest new aircraft order book among operating lessors, according to Simat Helliesen & Eichner, Inc., or SH&E, in each case by number of aircraft.

We lease most of our aircraft to airlines under operating leases. Under an operating lease, the lessee is responsible for the maintenance and servicing of the equipment during the lease term and the lessor receives the benefit, and assumes the risk, of the residual value of the equipment at the end of the lease. As of September 30, 2006, our owned and managed aircraft and engines were leased to 97 commercial airline and cargo operator customers in 47 countries and are managed from our offices in The Netherlands, Ireland and the United States. We expect to expand our leasing activity in Asia and in China in particular through our AerDragon joint venture with China Aviation Supplies Import & Export Group Corporation, which commenced operations in October 2006.

We have the infrastructure, expertise and resources to execute a large number of diverse aircraft and engine transactions in a variety of market conditions. From January 1, 2003 to September 30, 2006, we executed over 950 aircraft and engine transactions, including 245 aircraft leases, 232 engine leases, 101 aircraft purchase or sale transactions, 167 engine purchase or sale transactions and the disassembly of 40 aircraft and 133 engines. Our teams of dedicated marketing and asset trading professionals have been successful in leasing and trading our aircraft and engine portfolios. Between January 1, 2003 and September 30, 2006, our weighted average owned aircraft utilization rate was 98.8%.

In 2005, we generated total revenues of $628.2 million and net income of $108.4 million, and in the nine months ended September 30, 2006, we generated total revenues of $661.6 million and net

1

income of $104.9 million, each on a pro forma basis after giving effect to our acquisition by funds and accounts affiliated with Cerberus Capital Management, L.P., or the 2005 Acquisition, our acquisition of AeroTurbine, Inc., or the AeroTurbine Acquisition, and this offering, each as if it had occurred on January 1, 2005. Primarily as a result of an impairment charge to write off goodwill of our predecessor prior to the 2005 Acquisition we recorded a loss of $105.4 million and revenues of $390.9 million in 2004, the results of which did not include AeroTurbine.

Our Business Strategy

We intend to pursue the following business strategies. See "Business—Our Business Strategy" beginning on page 135 of this prospectus for a more detailed discussion of our business strategy.

Leverage Our Ability to Manage Aircraft and Engines Profitably throughout their Lifecycle. We intend to continue to leverage our integrated business model by selectively:

Our ability to profitably manage aircraft throughout their lifecycle depends in part on our successful integration of AeroTurbine, which we acquired in April 2006, our ability to successfully lease aircraft and engines at profitable rates and our ability to source acquisition opportunities of new and used aircraft at favorable prices.

Expand Our Aircraft and Engine Portfolio. We intend to grow our portfolio of aircraft and engines through portfolio purchases, new aircraft purchases, airline refleetings, and other opportunistic aircraft and engine purchases.

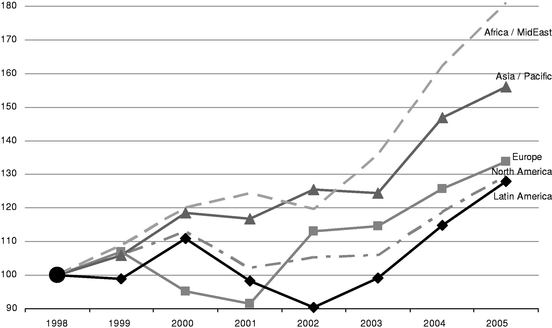

Focus on High Growth Markets. Although we maintain a geographically diverse portfolio, we focus on high growth airline markets such as the Asia/Pacific market.

Enter into Joint Ventures to Obtain Economies of Scale. We intend to continue to enter into joint ventures that increase our purchasing power and our ability to obtain price discounts on large aircraft orders.

Obtain Maintenance Cost Savings. We intend to lower our aircraft and engine maintenance costs by using aircraft and engine parts we obtain from the selective disassembly of acquired airframes and engines.

Acquire Complementary Businesses. We intend to selectively pursue acquisitions that we believe will enhance our ability to manage aircraft and engines profitably throughout their lifecycle.

2

Our Competitive Strengths

We believe the following competitive strengths will allow us to capitalize on growth opportunities in the global commercial aviation market. See "Business—Our Competitive Strengths" beginning on page 134 of this prospectus for a more detailed discussion of our competitive strengths.

Risks

An investment in our ordinary shares involves a high degree of risk. You should carefully consider the risks described in "Risk Factors" before making an investment decision. Our business, financial condition and results of operations could be materially and adversely affected by any of those risks. The trading price of our ordinary shares could decline due to any of those risks or other factors, and you may lose all or part of your investment. Below is a summary of the principal risks we face.

3

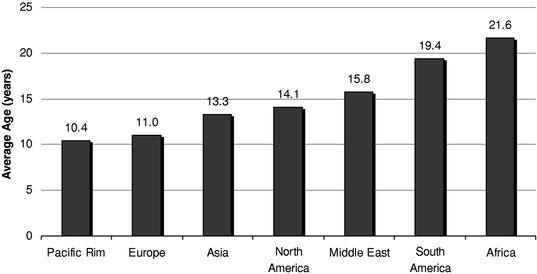

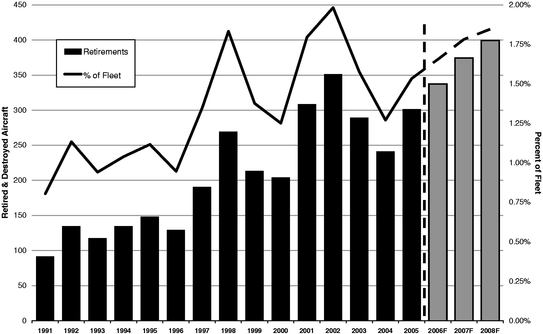

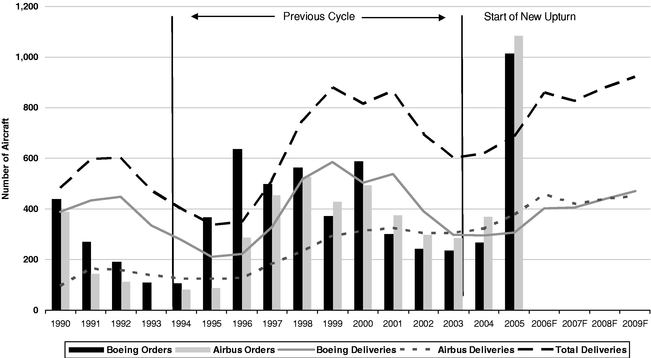

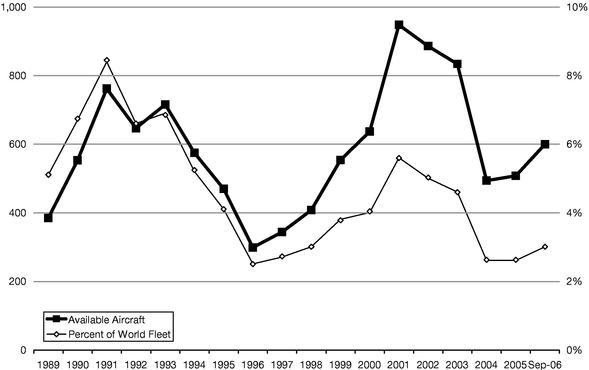

Industry Trends

We believe that trends in the aviation industry identified by SH&E, a recognized expert in the aviation industry, and described in "Aircraft, Engine and Aviation Parts Industry" create a favorable environment for us to leverage our competitive strengths and grow our business. We believe that our operating capabilities and aircraft and engine portfolios will provide us with a competitive advantage in the expanding aviation market. The trends identified by SH&E include:

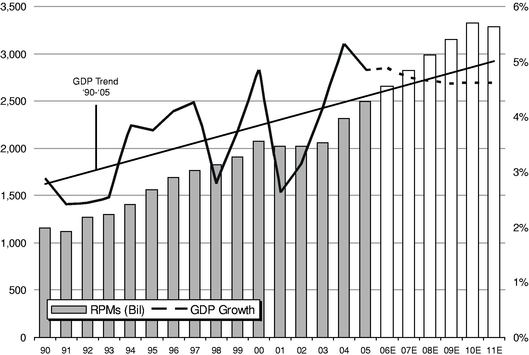

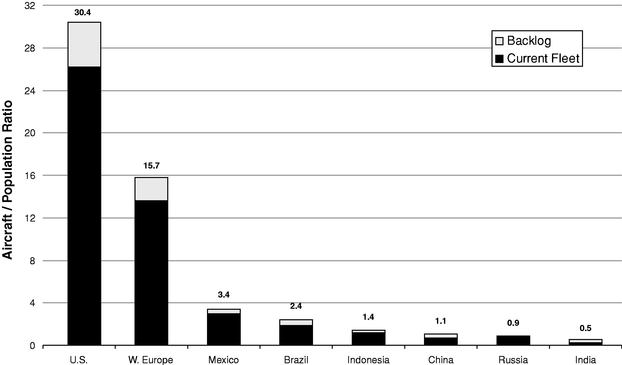

Growing Demand for Air Travel. Globalization and the rapid economic growth in major emerging markets such as India and China have fueled significant growth in global demand for air travel. The Airline Monitor, a commercial aviation data analysis publication, forecasts that air traffic will grow at an average rate of 5.2% per year through 2025.

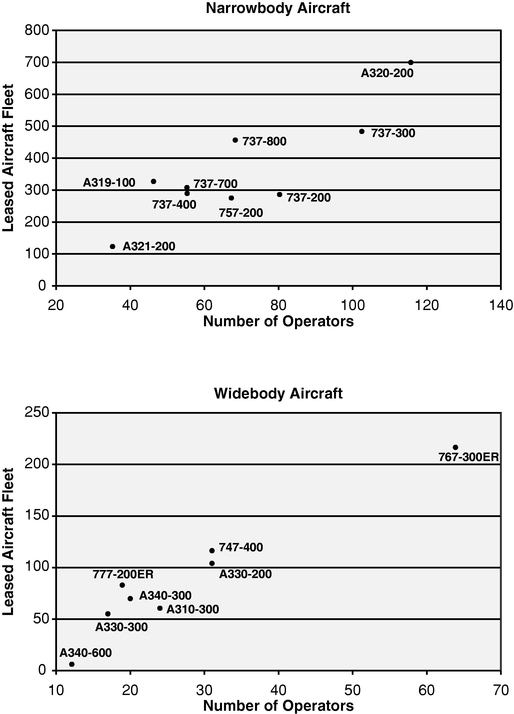

Fundamental Imbalance between Supply and Demand for Aircraft, Engines and Aircraft Equipment. In recent years, the increased demand for aircraft, engines and parts, combined with a decreased supply, has resulted in a supply-demand imbalance for certain aircraft, engines and parts. The primary factors affecting aircraft demand include rapid airline passenger growth in emerging markets, higher fuel prices, which has increased demand for fuel-efficient aircraft, the emergence of low cost carriers and industry restructuring in developed markets. The primary factors affecting aircraft supply include the aging world aircraft fleet, the significant backlog of aircraft production, the limited ability of airframe manufacturers to increase production and continued technological innovation in aviation equipment.

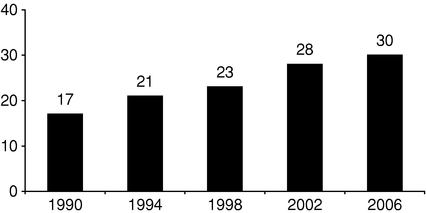

Greater Reliance on Operating Leases. In recent years, airlines have increasingly turned to operating leases to meet their aircraft financing needs. Operating leases permit airlines to reduce their capital commitments, improve their balance sheets, increase fleet planning flexibility and reduce residual value risk. According to SH&E, approximately 30% of the global aircraft fleet is currently operated under operating leases and SH&E forecasts that 40% of the global aircraft fleet will be operated under operating leases by 2020.

Despite these positive recent trends, the aircraft and engine leasing and trading industries have, in the past, experienced periods of aircraft and engine oversupply. The oversupply of a specific type of aircraft or engine is likely to depress the lease rates for, and the value of, that type of aircraft or engine. The supply and demand for aircraft and engines is affected by various cyclical and non-cyclical factors that are outside of our control.

4

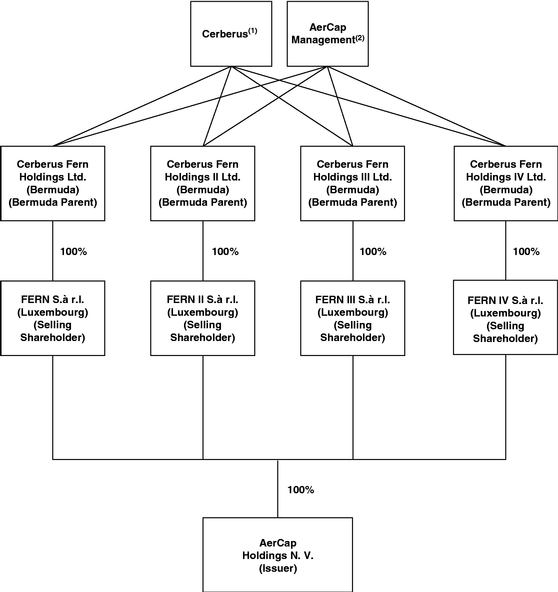

Our Corporate History and Shareholding Structure

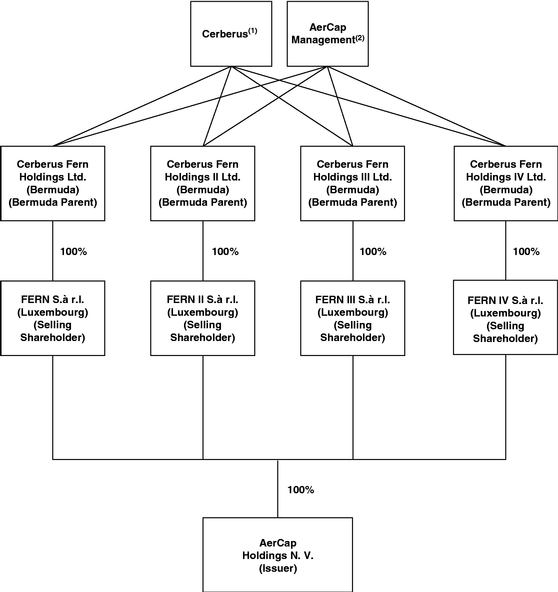

We were formed as a Netherlands public limited liability company ("naamloze vennootschap") on July 10, 2006 to acquire all of the assets and liabilities of AerCap Holdings C.V. a Netherlands limited partnership. AerCap Holdings C.V. was formed on June 27, 2005 for the purpose of acquiring all of the shares and certain liabilities of AerCap B.V. (formerly known as debis AirFinance B.V.). On June 30, 2005, AerCap Holdings C.V. acquired all of AerCap B.V.'s shares and liabilities owed by AerCap B.V. to its prior shareholders for total consideration of $1.4 billion, $370.0 million of which was funded with equity contributions by the selling shareholders. Substantially all of the equity funding for the 2005 Acquisition was provided by funds and accounts affiliated with Cerberus Capital Management, L.P., or Cerberus, who will retain control of us after this offering. Members of our senior management are also indirect shareholders of the selling shareholders. Assuming a public offering price of $23.00 per ordinary share, the mid-point of the price range set forth on the front cover of this prospectus and that all vested options exercisable on the closing date of this offering which have no exercise price are exercised on the closing date, Cerberus will receive $405.2 million from the proceeds of this offering if the underwriters do not exercise their over-allotment option and $475.4 million from the proceeds of this offering if the underwriters exercise their over-allotment option. See "Use of Proceeds" and "Principal and Selling Shareholders" for more information regarding our ownership structure and the proceeds that Cerberus as well as members of our senior management will receive from this offering.

On April 26, 2006, we acquired all of the existing share capital of AeroTurbine, Inc. an engine trading and leasing and parts sales company.

On October 27, 2006, AerCap Holdings N.V. acquired all of the assets and liabilities of AerCap Holdings C.V.

In connection with the hiring of Keith Helming, our new Chief Financial Officer, on August 21, 2006, Cerberus agreed to provide him equity incentives under an equity incentive plan offered by our indirect shareholders. Our indirect shareholders granted Mr. Helming options to purchase their common shares representing, in the aggregate, indirectly 977,962 of our ordinary shares. In addition, on September 5, 2006, our indirect shareholders granted options to acquire their shares to four non-executive directors that are not employees of Cerberus as follows: Pieter Korteweg (111,767 AerCap Holdings N.V. equivalent shares prior to the offering); James N. Chapman (111,767 equivalent shares); Marius J.L. Jonkhart (55,884 equivalent shares) and Ronald J. Bolger (55,884 equivalent shares). Also on September 5, 2006, our indirect shareholders granted options to acquire their shares to two members of senior management as follows: Aengus Kelly (215,268 equivalent shares) and Wouter M. (Erwin) den Dikken (107,634 equivalent shares). The AerCap Holdings N.V. equivalent exercise price for each option granted on August 21, 2006 or September 5, 2006 is $5.28 and was determined through extensive discussions with the option recipients and based on indications of private company valuations during the early stages of such discussions. See "Management—Equity Incentive Plan—Issuance under Bermuda Parents Incentive Plans".

Financial Results for the Three Months Ended December 31, 2006

Our financial results for the three months ended December 31, 2006 will be affected by non-cash compensation expense we will recognize from the vesting of options and restricted stock previously granted or sold to the owners of AeroTurbine at the time of its acquisition by us and to members of our senior management and one consultant primarily in connection with the 2005 Acquisition. As a result, assuming an initial public offering price of $23.00 per ordinary share, the mid-point of the price range set forth on the cover of this prospectus, we expect to recognize approximately $73 million of non-cash compensation expense before tax in the fourth quarter of 2006 and expect to report a net loss for the period. See "Management's Discussion of Results of Operations and Financial Position—Operating Expenses—Selling, General and Administrative Expenses".

5

The following chart sets forth our shareholders' ownership structure prior to this offering.

Our principal executive offices are located at Evert van de Beekstraat 312, 1118 CX Schiphol Airport, The Netherlands, and our general telephone number is +31 20 655-9655. Our website address is www.aercap.com. Information contained on our website does not constitute a part of this prospectus.

* * *

6

Explanatory Note Regarding Our Aircraft Portfolio

Unless otherwise noted or the context requires, all references in this prospectus to:

In this prospectus, unless otherwise specified, when we discuss our aircraft portfolio, we describe our owned and managed portfolio as of September 30, 2006. References to lease revenues from our aircraft portfolio are to our owned portfolio for the year ended December 31, 2005 or prior periods where indicated.

The definitions above are intended to include, where the context requires, all relevant aircraft in the same categories in the future. References to the number of aircraft and engines we lease, buy, sell and have on order in this prospectus include our owned and managed aircraft and engines. Also, unless the context otherwise requires, all weighted average age percentages and weighted average lease terms of owned aircraft in this prospectus have been calculated using net book value.

7

| Shares offered in this offering: | |||

Ordinary shares offered by us |

6,800,000 shares |

||

Ordinary shares offered by the selling shareholders |

19,300,000 shares |

||

Over-allotment option: |

|||

Ordinary shares offered by the selling shareholders |

3,915,000 shares |

||

Total ordinary shares outstanding after the offering |

85,036,957 shares |

||

Selling shareholders |

Four Luxembourg limited liability companies indirectly owned by Cerberus and members of our senior management. |

||

Use of proceeds |

We will use the net proceeds from the sale of our ordinary shares to repay a portion of our outstanding senior secured term loan and/or junior subordinated loan incurred in connection with our acquisition of AeroTurbine in April 2006. Cerberus and members of our senior management will not receive any of the proceeds from the sale of ordinary shares by us. Cerberus and members of our senior management will receive all of the net proceeds from the sale of the ordinary shares being offered by the selling shareholders. We will not receive any net proceeds from the sale of the ordinary shares by the selling shareholders. See "Use of Proceeds". |

||

Dividend Policy |

To date, we have not declared or paid any dividends on our ordinary shares. We intend to retain our future earnings to fund working capital and our growth and do not expect to pay dividends in the foreseeable future. See "Dividend Policy". |

||

Risk Factors |

See "Risk Factors" beginning on page 15 of this prospectus and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the ordinary shares. |

||

Listing |

Our ordinary shares have been authorized for listing on the New York Stock Exchange under the symbol "AER". |

||

Tax Considerations |

See "Tax Considerations" beginning on page 189. |

||

Unless the context otherwise requires, all information in this prospectus:

8

SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATA

The following table presents AerCap Holdings C.V.'s (the successor company) and AerCap B.V.'s (the predecessor company) summary historical consolidated financial and operating data for each of the periods indicated, prepared in accordance with generally accepted accounting principles in the United States, or US GAAP. You should read this information in conjunction with AerCap Holdings C.V.'s audited consolidated financial statements and related notes, unaudited condensed consolidated interim financial statements and related notes and the information under "Selected Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this prospectus.

AerCap Holdings N.V. was formed as a Netherlands public limited liability company ("naamloze vennootschap") on July 10, 2006 and acquired all of the assets and liabilities of AerCap Holdings C.V., a Netherlands limited partnership on October 27, 2006. AerCap Holdings C.V. was formed on June 27, 2005 for the purpose of acquiring all of the shares and certain liabilities of AerCap B.V. (formerly known as debis AirFinance B.V.) in connection with the 2005 Acquisition. The financial information presented as of and for the fiscal years ended December 31, 2003 and 2004 and the six months ended June 30, 2005 and December 31, 2005 was derived from AerCap Holdings C.V.'s audited consolidated financial statements included in this prospectus. The financial information presented for the three months ended September 30, 2005 and as of and for the nine months ended September 30, 2006 was derived from AerCap Holding C.V.'s unaudited condensed consolidated interim financial statements included in this prospectus.

| |

AerCap B.V. |

AerCap Holdings C.V. |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended |

Six months ended |

Three months ended |

Six months ended |

Nine months ended |

||||||||||||||

| |

December 31, |

|

|

|

|

||||||||||||||

| |

2003 (restated) (1)(2)(3) |

2004 (restated) (2)(3) |

June 30, 2005 (3) |

September 30, 2005 |

December 31, 2005 (3)(4) |

September 30, 2006* |

|||||||||||||

| |

(In thousands, except per share amounts) |

||||||||||||||||||

| Consolidated Income Statements Data: | |||||||||||||||||||

Revenues |

|||||||||||||||||||

| Lease revenue | $ | 343,045 | $ | 308,500 | $ | 175,333 | $ | 81,325 | $ | 173,568 | $ | 311,131 | |||||||

| Sales revenue | 7,499 | 32,050 | 79,574 | — | 12,489 | 236,665 | |||||||||||||

| Management fee revenue | 13,400 | 15,009 | 6,512 | 4,044 | 7,674 | 10,330 | |||||||||||||

| Interest revenue | 22,432 | 21,641 | 13,130 | 10,448 | 20,335 | 26,656 | |||||||||||||

| Other revenue | 84,568 | 13,667 | 3,459 | 174 | 1,006 | 18,014 | |||||||||||||

| Total revenues | 470,944 | 390,867 | 278,008 | 95,991 | 215,072 | 602,796 | |||||||||||||

Expenses |

|||||||||||||||||||

| Depreciation and amortization | 143,303 | 125,877 | 66,407 | 22,477 | 45,918 | 72,347 | |||||||||||||

| Cost of goods sold | 6,657 | 18,992 | 57,632 | — | 10,574 | 183,264 | |||||||||||||

| Interest on term debt | 123,435 | 113,132 | 69,857 | 24,868 | 44,742 | 111,432 | |||||||||||||

| Impairments(5) | 6,066 | 134,671 | — | — | — | — | |||||||||||||

| Other expenses | 87,079 | 66,940 | 26,726 | 10,708 | 26,656 | 44,676 | |||||||||||||

| Selling, general and administrative expenses | 39,267 | 36,449 | 19,559 | 10,937 | 26,949 | 66,571 | |||||||||||||

| Total expenses | 405,807 | 496,061 | 240,181 | 68,990 | 154,839 | 478,290 | |||||||||||||

Income (loss) from continuing operations before income taxes and minority interests |

65,137 |

(105,194 |

) |

37,827 |

27,001 |

60,233 |

124,506 |

||||||||||||

Provision for income taxes |

(28,222 |

) |

(168 |

) |

(4,127 |

) |

(4,086 |

) |

(10,570 |

) |

(20,094 |

) |

|||||||

| Minority interests net of tax | — | — | — | — | — | 730 | |||||||||||||

Net income (loss) |

$ |

36,915 |

$ |

(105,362 |

) |

$ |

33,700 |

$ |

22,915 |

$ |

49,663 |

$ |

105,142 |

||||||

Earnings (loss) per share, basic and diluted |

50.14 |

(143.12 |

) |

45.78 |

— |

— |

— |

||||||||||||

| Weighted average shares outstanding, basic and diluted | 736 | 736 | 736 | — | — | — | |||||||||||||

| Pro forma earnings per share, basic and diluted, due to change in organizational structure (unaudited)(6) | — | — | — | 0.27 | 0.60 | 1.29 | |||||||||||||

| Pro forma weighted average shares, basic and diluted, (unaudited)(6) | — | — | — | 78,237 | 78,237 | 78,237 | |||||||||||||

9

| |

AerCap B.V. |

AerCap Holdings C.V. |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended |

Six months ended |

Three months ended |

Six months ended |

Nine months ended |

||||||||||||||

| |

December 31, |

|

|

|

|

||||||||||||||

| |

|

|

December 31, 2005 (restated) (2)(4) |

|

|||||||||||||||

| |

2003 (restated) (1)(2) |

2004 (restated) (2) |

June 30, 2005 (restated)(2) |

September 30, 2005 |

September 30, 2006* |

||||||||||||||

| |

(US dollars in thousands) |

||||||||||||||||||

| Consolidated Statements of Cash Flows Data: | |||||||||||||||||||

| Net cash provided by operating activities | $ | 123,614 | $ | 91,933 | $ | 107,275 | $ | 43,323 | $ | 109,238 | $ | 176,292 | |||||||

| Net cash (used in) provided by investing activities | (316,170 | ) | (218,481 | ) | 14,525 | (1,657,330 | ) | (1,431,259 | ) | (344,483 | ) | ||||||||

| Net cash provided by (used in) financing activities | 237,901 | 136,546 | (142,005 | ) | 1,708,802 | 1,505,472 | 201,224 | ||||||||||||

Other Financial Data (unaudited): |

|||||||||||||||||||

| EBITDA(7) | $ | 331,875 | $ | 133,815 | $ | 174,091 | $ | 74,346 | $ | 150,893 | $ | 309,015 | |||||||

| |

AerCap Holdings C.V. |

|||||

|---|---|---|---|---|---|---|

| |

As of December 31, 2005 |

As of September 30, 2006 |

||||

| |

(US dollars in thousands) |

|||||

| Consolidated Balance Sheet Data: | ||||||

| Assets | ||||||

| Cash and cash equivalents | $ | 183,554 | $ | 215,325 | ||

| Restricted cash | 157,730 | 125,065 | ||||

| Flight equipment held for operating leases, net | 2,189,267 | 2,542,119 | ||||

| Notes receivable, net of provisions | 196,620 | 158,303 | ||||

| Prepayments on flight equipment | 115,657 | 129,496 | ||||

| Other assets | 218,405 | 381,039 | ||||

| Total assets | $ | 3,061,233 | $ | 3,551,347 | ||

| Term debt | 2,172,995 | 2,458,977 | ||||

| Other liabilities | 468,575 | 552,601 | ||||

| Partners' capital | 419,663 | 539,769 | ||||

| Total liabilities and partners' capital | $ | 3,061,233 | $ | 3,551,347 | ||

10

11

| |

AerCap B.V. |

AerCap Holdings C.V. |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended December 31, |

Six months ended |

Three months ended |

Six months ended |

Nine months ended |

|||||||||||||

| |

2003(1) |

2004 |

June 30, 2005(3) |

September 30, 2005 |

December 31, 2005(3)(4) |

September 30, 2006 |

||||||||||||

| |

(US dollars in thousands) (unaudited) |

|||||||||||||||||

| EBITDA Reconciliation: | ||||||||||||||||||

| Net income (loss) | $ | 36,915 | $ | (105,362 | ) | $ | 33,700 | $ | 22,915 | $ | 49,663 | $ | 105,142 | |||||

| Depreciation and amortization | 143,303 | 125,877 | 66,407 | 22,477 | 45,918 | 72,347 | ||||||||||||

| Interest on term debt | 123,435 | 113,132 | 69,857 | 24,868 | 44,742 | 111,432 | ||||||||||||

| Provision for income taxes | 28,222 | 168 | 4,127 | 4,086 | 10,570 | 20,094 | ||||||||||||

| EBITDA | $ | 331,875 | $ | 133,815 | $ | 174,091 | $ | 74,346 | $ | 150,893 | $ | 309,015 | ||||||

12

SUMMARY UNAUDITED CONSOLIDATED PRO FORMA FINANCIAL INFORMATION

The following summary unaudited consolidated pro forma income statements for the nine months ended September 30, 2005 and 2006 and for the year ended December 31, 2005 have been derived by the application of pro forma adjustments to AerCap Holdings C.V.'s unaudited condensed consolidated interim financial statements and audited consolidated financial statements and AeroTurbine's audited combined financial statements included in this prospectus and AeroTurbine's unaudited combined interim financial statements for the period from January 1, 2006 to April 25, 2006 that are not included in this prospectus.

The summary unaudited consolidated pro forma income statement for the nine months ended September 30, 2006 gives effect to the following as if they had occurred on January 1, 2005:

The summary unaudited consolidated pro forma income statements for the nine months ended September 30, 2005 and the year ended December 31, 2005 give effect to the following as if they had occurred on January 1, 2005:

The summary unaudited consolidated pro forma financial information is based on assumptions and preliminary data and reflects adjustments described under "Unaudited Consolidated Pro Forma Financial Information" and the accompanying notes. The summary unaudited consolidated pro forma financial information is being furnished solely for informational purposes and is not intended to represent or be indicative of the results that we would have reported if the transactions identified above had occurred on the dates indicated, nor does it purport to represent the results of operations we will obtain in future periods. The summary unaudited consolidated pro forma financial information should be read in conjunction with AerCap Holdings C.V's unaudited condensed consolidated interim financial statements and the related notes, AerCap Holdings C.V.'s audited consolidated financial statements and related notes and AeroTurbine's audited combined financial statements and the related notes included in this prospectus.

For additional information regarding our summary unaudited consolidated pro forma financial information, see "Unaudited Consolidated Pro Forma Financial Information".

13

Summary Unaudited Consolidated Pro Forma Financial Information

| |

|

Nine months ended |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended December 31, 2005 |

September 30, 2005 |

September 30, 2006 |

|||||||

| |

(US dollars in thousands, except per share amounts) |

|||||||||

| Consolidated Income Statement Data: | ||||||||||

| Revenues | ||||||||||

| Lease revenue | $ | 390,757 | $ | 285,575 | $ | 328,701 | ||||

| Sales revenue | 179,809 | 148,550 | 277,803 | |||||||

| Management fee revenue | 14,186 | 10,556 | 10,330 | |||||||

| Interest revenue | 38,083 | 28,193 | 26,661 | |||||||

| Other revenue | 5,380 | 3,803 | 18,070 | |||||||

| Total revenues | 628,215 | 476,677 | 661,565 | |||||||

Expenses |

||||||||||

| Depreciation and amortization | 108,206 | 79,753 | 76,049 | |||||||

| Cost of goods sold | 134,930 | 105,409 | 216,379 | |||||||

| Interest on term debt | 100,218 | 84,621 | 108,323 | |||||||

| Operating lease in costs | 24,086 | 19,120 | 18,925 | |||||||

| Leasing expenses | 33,879 | 23,322 | 30,251 | |||||||

| Provision for doubtful notes and accounts receivable | 6,163 | 2,944 | (847 | ) | ||||||

| Selling, general and administrative expenses | 87,135 | 61,617 | 82,381 | |||||||

| Total expenses | 494,617 | 376,786 | 531,461 | |||||||

| Income from continuing operations before income taxes and minority interests | 133,598 | 99,891 | 130,104 | |||||||

Provision for income taxes |

(25,191 |

) |

(18,507 |

) |

(25,906 |

) |

||||

| Minority interests net of taxes | — | — | 730 | |||||||

| Net income | $ | 108,407 | $ | 81,384 | $ | 104,928 | ||||

| Net income per share (basic/diluted) | 1.27 | 0.96 | 1.23 | |||||||

14

An investment in our ordinary shares involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. The trading price of our ordinary shares could decline due to any of these risks or other factors, and you may lose all of part or your investment. The risks described below are those that we currently believe may materially affect us. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus.

Risks Related to Our Business

Our business model depends on the continual re-leasing of our aircraft and engines when current leases expire, and we may not be able to do so on favorable terms, if at all.

Our business model depends on the continual re-leasing of our aircraft and engines when our current leases expire in order to generate sufficient revenues to finance our growth and operations and pay our debt service obligations. Between September 30, 2006 and December 31, 2009, aircraft leases accounting for approximately 58.0% of our lease revenues for the year ended December 31, 2005, are scheduled to expire and the aircraft subject to those leases will need to be re-leased or extended. In addition, nearly all of our engines are subject to short-term leases, which are generally less than 180 days. Our ability to re-lease our aircraft and engines will depend on general market and competitive conditions at the time the leases expire. The general market and competitive conditions may be affected by many factors which are outside of our control.

In 2005, we generated $12.3 million of revenues from leases that were scheduled to expire in the three months ended December 31, 2006, $50.2 million of revenues from leases that were scheduled to expire in 2007, $54.6 million of revenues from leases that were scheduled to expire in 2008 and $85.1 million of revenues from leases that were scheduled to expire in 2009. Since we lease most of our engines under short-term leases (90 to 180 days), we generally re-lease our engines at least once a year. If we are unable to re-lease an aircraft or engine on acceptable terms, our lease revenue may decline and we may need to sell the aircraft or engines at unfavorable prices to provide adequate funds for our debt service obligations and to otherwise finance our growth and operations.

If we are unable to successfully integrate AeroTurbine, we may not be able to implement our business strategy.

We acquired AeroTurbine in April 2006. Our inability to integrate AeroTurbine would adversely affect a critical component of our business strategy which is focused on leveraging our ability to manage aircraft profitably throughout their lifecycle. AeroTurbine's engine leasing business, airframe and engine disassembly business and its MRO capabilities are critical components of this strategy because we believe that these businesses and capabilities broaden our ability to extract value from a wide range of aircraft assets, particularly older aircraft, and to lower our maintenance costs. Our ability to successfully integrate AeroTurbine will depend, in part, on the efforts of the former owners of AeroTurbine who are currently its Chief Executive Officer and Chief Operating Officer. If we are unable to successfully integrate AeroTurbine, we may acquire aircraft and engines that we may not be able to lease at attractive rates, if at all, or profitably disassemble for sale by our parts business. As a result, we may overpay for new aircraft or engines that we acquire. AeroTurbine has different management information and accounting systems than we do, which will need to be integrated into our systems. As we integrate these systems we may discover weaknesses or limitations in AeroTurbine's management information and accounting systems and internal controls. We may be required to hire

15

additional personnel at AeroTurbine as it transitions to becoming part of our consolidated group and we become a public company. In addition, even if we are able to successfully integrate AeroTurbine, we may be required to incur increased or unanticipated costs. If we are unable to successfully integrate AeroTurbine or if we experience increased costs in integrating AeroTurbine, we may not be able to implement our business strategy, our financial results and growth prospects may be materially and adversely affected, and we may fail to benefit from the synergies we expect to result from the AeroTurbine Acquisition.

Changes in interest rates may adversely affect our financial results and growth prospects.

We use floating rate debt to finance the acquisition of a significant portion of our aircraft and engines. All of our revolving credit facilities have floating interest rates. As of December 31, 2005 and September 30, 2006, we had $1.8 billion and $2.1 billion, respectively, of indebtedness outstanding that was floating rate debt. We incurred floating rate interest expense of $87.1 million in the nine months ended September 30, 2006. If interest rates increase, we would be obligated to make higher interest payments to our lenders. Our practice has been to hedge the expected future interest payments on a portion of our floating-rate liabilities by entering into derivative contracts. However, we remain exposed to changes in interest rates to the extent that our hedges are not perfectly correlated to our financial liabilities. In addition, if we incur significant fixed rate debt in the future, increased interest rates prevailing in the market at the time of the incurrence or refinancing of such debt will also increase our interest expense.

Changes in interest rates may also adversely affect our lease revenues generated from leases with lease rates tied to floating interest rates. In the nine months ended September 30, 2006, 31.7% of our lease revenue was attributable to leases tied to floating interest rates. Therefore, if interest rates were to decrease, our lease revenue would decrease. In addition, because our fixed rate leases are based, in part, on prevailing interest rates at the time we enter into the lease; if interest rates decrease, new leases we enter into will be at lower lease rates and our lease revenue will be adversely affected. As of December 31, 2005, if interest rates were to increase by 1%, we would expect to incur an increase in interest expense on our floating rate indebtedness of approximately $9.1 million on an annualized basis, excluding the offsetting benefits of interest rate hedges currently in effect, and, if interest rates were to decrease by 1%, we would expect to generate $9.5 million less lease revenue on an annualized basis.

The aircraft and engine leasing, trading and parts sales businesses have historically experienced prolonged periods of oversupply during which lease rates and aircraft values have declined, and any future oversupply could materially and adversely affect our financial results and growth prospects.

In the past, the aircraft and engine leasing, buying and selling businesses have experienced prolonged periods of aircraft and engine oversupply. The oversupply of a specific type of aircraft or engine is likely to depress the lease rates for and the value of that type of aircraft or engine. The supply and demand for aircraft and engines is affected by various cyclical and non-cyclical factors that are outside of our control, including:

16

These factors may produce sharp and prolonged decreases in aircraft and engine lease rates and values, and have a material adverse effect on our ability to re-lease our aircraft and engines and/or sell our aircraft engines and parts at acceptable prices. Any of these factors could materially and adversely affect our financial results and growth prospects.

Our financial condition is dependent, in part, on the financial strength of our lessees; lessee defaults and other credit problems could adversely affect our financial results and growth prospects.

Our financial condition depends on the financial strength of our lessees, our ability to diligence and appropriately assess the credit risk of our lessees and the ability of lessees to perform under their leases. In 2005 and in the nine months ended September 30, 2006, we generated 62.2% and 49.7%, respectively, of our pro forma revenues from leases to the airline industry, and as a result, we are indirectly affected by all the risks facing airlines today. The ability of our lessees to perform their obligations under our leases will depend primarily on the lessee's financial condition and cash flow, which may be affected by factors outside our control, including:

Generally, airlines with high debt leverage are more likely than airlines with stronger balance sheets to seek operating leases. As a result, many of our existing lessees are in a weakened financial condition and may suffer liquidity problems, and, at any point in time, may experience lease payment difficulties or be significantly in arrears in their obligations under our operating leases. Some lessees encountering financial difficulties may seek a reduction in their lease rates or other concessions, such as a decrease in their contribution toward maintenance obligations. Any future downturns in the airline industry could greatly exacerbate the weakened financial condition and liquidity problems of some of

17

our lessees and further increase the risk of delayed, missed or reduced rental payments. We may not correctly assess the credit risk of each lessee or charge lease rates which correctly reflect the related risks and our lessees may not be able to continue to meet their financial and other obligations under our leases in the future. A delayed, missed or reduced rental payment from a lessee decreases our revenues and cash flow. Our default levels may increase over time if economic conditions deteriorate. If lessees of a significant number of our aircraft or engines default on their leases, our financial results and growth prospects will be adversely affected.

The value and lease rates of our aircraft and engines could decline and this would have a material adverse effect on our financial results and growth prospects.

Aircraft and engine values and lease rates have historically experienced sharp decreases due to a number of factors including, but not limited to, decreases in passenger and air cargo demand, increases in fuel costs, government regulation and increases in interest rates. In addition to factors linked to the aviation industry generally, many other factors may affect the value and lease rates of our aircraft and engines, including:

Any decrease in the value and lease rates of aircraft or engines which may result from the above factors or other unanticipated factors, may have a material adverse effect on our financial results and growth prospects.

The concentration of some aircraft and engine models in our aircraft and engine portfolios could adversely affect our business and financial results should any problems specific to these particular models occur.

Due to the high concentration of Airbus A320 family aircraft and CFM56 family engines in our aircraft and engine portfolios, our financial results and growth prospects may be adversely affected if the demand for these aircraft or engine models declines, if they are redesigned or replaced by their manufacturer or if these aircraft or engine models experience design or technical problems. As of September 30, 2006, 89.1% of the net book value of our aircraft portfolio was represented by Airbus aircraft. Our owned aircraft portfolio included 12 aircraft types, the three highest concentrations of which together represented 76.0% of our aircraft by net book value, were Airbus A320 aircraft,

18

representing 31.0% of the net book value of our aircraft portfolio, Airbus A321 aircraft, representing 27.0% of the net book value of our aircraft portfolio, and Airbus A330 aircraft, representing 18.0% of the net book value of our aircraft portfolio, as of September 30, 2006. No other aircraft type represented more than 10% of our portfolio by net book value. In addition to our significant number of existing Airbus aircraft, we have 79 new Airbus A320 family aircraft on order either directly or indirectly through our consolidated joint venture, AerVenture, and have signed a letter of intent to purchase 20 new Airbus A330-200 widebody aircraft. We also have a significant concentration of CFM56 engines in our engine portfolio. As of September 30, 2006, 76.4% of the net book value of our engine portfolio was represented by CFM56 engines and 18.0% was represented by CF6 engines.

Should any of these aircraft or engine types or aircraft manufactured by Airbus in general encounter technical or other problems, the value and lease rates of those aircraft or engines will likely decline, and we may be unable to lease the aircraft or engines on favorable terms, if at all. Any significant technical problems with any such aircraft or engine models could result in the grounding of the aircraft or engines.

In addition, if Airbus experiences further financial difficulty we could be adversely affected. Airbus has announced that production delays on Airbus's A380 megajet are expected to reduce profits from 2007 to 2010 by $6 billion. Airbus has also announced that it will need to spend up to $10 billion to redesign its A350 aircraft. Following these announcements, the chief executive officers were forced to resign and were replaced. A new chief executive officer was appointed on July 3, 2006; however, amid announcements of further delays of the A380 aircraft and additional cost overruns, Airbus's chief executive officer resigned on October 9, 2006 and was replaced by the co-chief executive officer of Airbus's principal shareholder. Airbus's new chief executive officer will continue to serve as the co-chief executive officer of its principal shareholder. If Airbus experiences further financial and other difficulties and is unable to deliver the aircraft we have ordered from it on time or at all, we could lose the benefit of the terms of AerVenture in its Airbus purchase contract and could be unable to obtain replacement aircraft on comparable terms, or at all, which could materially and adversely affect our results of operations and growth prospects. If Airbus were to enter into reorganization or bankruptcy, we could in addition lose payments made towards aircraft not yet delivered.

Any decrease in the value and lease rates of our aircraft and engines may have a material adverse effect on our financial results and growth prospects.

We are indirectly subject to many of the economic and political risks associated with emerging markets, which could adversely affect our financial results and growth prospects.

A significant number of our aircraft and engines are leased to airlines in emerging market countries. As of September 30, 2006, we leased 58.7% of our aircraft and 32.5% of our engines, weighted by net book value, to airlines in emerging market countries. The emerging markets in which our aircraft are operated include Thailand, India, Taiwan, Sri Lanka, El Salvador, Jamaica, Malaysia, Colombia, Mexico, Nepal, Turkey, Hungary, Trinidad and Tobago, Russia, Brazil, the Slovak Republic and Indonesia.

Emerging market countries have less developed economies that are more vulnerable to economic and political problems and may experience significant fluctuations in gross domestic product, interest rates and currency exchange rates, as well as civil disturbances, government instability, nationalization and expropriation of private assets and the imposition of taxes or other charges by government authorities. The occurrence of any of these events in markets served by our lessees and the resulting economic instability that may arise could adversely affect the value of our ownership interest in aircraft or engines subject to lease in such countries, or the ability of our lessees which operate in these markets to meet their lease obligations. As a result, lessees which operate in emerging market countries

19

may be more likely to default than lessees that operate in developed countries. In addition, legal systems in emerging market countries may be less developed, which could make it more difficult for us to enforce our legal rights in such countries. For these and other reasons, our financial results and growth prospects may be materially and adversely affected by adverse economic and political developments in emerging market countries.

If our lessees encounter financial difficulties and we decide to restructure our leases, the restructuring would likely result in less favorable leases which could adversely affect our financial results and growth prospects.

If a lessee is late in making payments, fails to make payments in full or in part under a lease or has advised us that it will fail to make payments in full or in part under a lease in the future, we may elect or be required to restructure the lease, which could result in less favorable terms or termination of a lease without receiving all or any of the past due amounts. We may be unable to agree upon acceptable terms for some or all of the requested restructurings and as a result may be forced to exercise our remedies under those leases. If we, in the exercise of our remedies, repossess an aircraft or engine, we may not be able to re-lease the aircraft or engine promptly at favorable rates, if at all. You should expect that restructurings and/or repossessions with some lessees will occur in the future. The terms and conditions of possible lease restructurings may result in a significant reduction of lease revenue, which may adversely affect our financial results and growth prospects.

If we or our lessees fail to maintain our aircraft or engines, their value may decline and we may not be able to lease or re-lease our aircraft and engines at favorable rates, if at all, which would adversely affect our financial results and growth prospects.

We may be exposed to increased maintenance costs for our leased aircraft and engines associated with a lessee's failure to properly maintain the aircraft or engine or pay supplemental maintenance rent. If an aircraft or engine is not properly maintained, its market value may decline which would result in lower revenues from its lease or sale. Under our leases, our lessees are primarily responsible for maintaining the aircraft and engines and complying with all governmental requirements applicable to the lessee and the aircraft and engines, including operational, maintenance, government agency oversight, registration requirements and airworthiness directives. Although we require many of our lessees to pay us a supplemental maintenance rent, failure of a lessee to perform required maintenance during the term of a lease could result in a decrease in value of an aircraft or engine, an inability to re-lease an aircraft or engine at favorable rates, if at all, or a potential grounding of an aircraft or engine. Maintenance failures by a lessee would also likely require us to incur maintenance and modification costs upon the termination of the applicable lease, which could be substantial, to restore the aircraft or engine to an acceptable condition prior to sale or re-leasing. Supplemental maintenance rent paid by our lessees may not be sufficient to fund our maintenance costs. Our lessees' failure to meet their obligations to pay supplemental maintenance rent or perform required scheduled maintenance or our inability to maintain our aircraft or engines may materially and adversely affect our financial results and growth prospects.

Competition from other aircraft or engine lessors with greater resources or a lower cost of capital than us could adversely affect our financial results and growth prospects.

The aircraft and engine leasing industry is highly competitive. Our competition is comprised of major aircraft leasing companies including GE Commercial Aviation Services, International Lease Finance Corp., CIT Group, Aviation Capital Group, Pegasus Aviation, GATX Air, Aircastle Limited, RBS Aviation Capital, AWAS, Babcock & Brown, Boeing Capital Corp., Pembroke Group Ltd. and Singapore Aircraft Leasing Enterprise, and six major engine leasing companies, including GE Engine

20

Leasing, Engine Lease Finance Corporation, Pratt & Whitney Engine Leasing LLC, Willis Lease Finance Corporation, Rolls-Royce and Partners Finance and Shannon Engine Support Ltd. Some of our competitors are significantly larger and have greater resources or lower cost of capital than us; accordingly, they may be able to compete more effectively in one or more of our markets. On October 18, 2006, GE Commercial Aviation Services completed the acquisition of The Memphis Group, Inc., an aircraft parts trading company. This acquisition could provide competition to our integrated business strategy.

In addition, we may encounter competition from other entities such as:

Some of these competitors have greater operating and financial resources and access to lower capital costs than us. We may not always be able to compete successfully with such competitors and other entities, which could materially and adversely affect our financial results and growth prospects.

We are exposed to significant regional political and economic risks due to the concentration of our lessees in certain geographical regions which could adversely affect our financial results and growth prospects.

Through our lessees, we are exposed to local economic and political conditions. Such adverse economic and political conditions include additional regulation or, in extreme cases, requisition of our aircraft or engines. The effect of these conditions on payments to us will be more or less pronounced, depending on the concentration of lessees in the region with adverse conditions. The airline industry is highly sensitive to general economic conditions. A recession or other worsening of economic conditions or a terrorist attack, particularly if combined with high fuel prices or a weak euro or other local currency, may have a material adverse effect on the ability of our lessees to meet their financial and other obligations under our leases.

Lease rental revenues from 23 lessees based in Asia accounted for 39.9% of our pro forma lease revenues in 2005. The outbreak of SARS in 2003 had a significant negative effect on the Asian economy, particularly in China, Hong Kong and Taiwan. The Asian airline industry has since recovered and is currently experiencing strong growth; however, a recurrence of SARS or the outbreak of another epidemic disease, such as avian influenza, which many experts believe would originate in Asia, could materially and adversely affect the Asian airline industry.

Lease rental revenues from 38 lessees based in Europe accounted for 32.3% of our pro forma lease revenues in 2005. Commercial airlines in Europe face, and can be expected to continue to face, increased competitive pressures, in part as a result of the deregulation of the airline industry by the European Union and the resulting expansion of low-cost carriers. European countries generally have relatively strict environmental regulations and traffic constraints that can restrict operational flexibility

21

and decrease aircraft productivity, which could significantly increase operating costs of all aircraft, including our aircraft, thereby adversely affecting our lessees.

Lease rental revenues from 25 lessees based in North America accounted for 16.0% of our pro forma lease revenues in 2005. During the past 15 years, a number of North American passenger airlines filed for bankruptcy and several major U.S. airlines ceased operations altogether. The outbreak of SARS, the war and prolonged conflict in Iraq and the September 11, 2001 terrorist attacks in the United States have imposed additional financial burdens on most U.S. airlines as a result of increased expenses due to tightened security requirements and reduced demand for air travel. Lease revenues from two lessees based in the Caribbean, accounted for 3.6% of our pro forma lease revenues in 2005.

Lease revenues from ten lessees based in Latin America account for 8.2% of our pro forma lease revenues in 2005. The economies of Latin American countries are generally characterized by lower levels of foreign investment when compared to industrialized countries and greater economic volatility. Any economic downturn in the Latin American or the Caribbean economies may adversely affect the operations of our lessees in these regions.

Our substantial indebtedness incurred to acquire our aircraft and engines requires significant debt service payments.

As of September 30, 2006, our consolidated indebtedness was $2.5 billion and our interest on term debt expense (including the impact of hedging activities) was $69.9 million, $44.7 million and $111.4 million in the six months ended June 30, 2005, the six months ended December 31, 2005 and the nine months ended September 30, 2006, respectively. Due to the capital intensive nature of our business and our strategy of expanding our aircraft and engine portfolios, we expect that we will incur additional indebtedness in the future and continue to maintain high levels of indebtedness. In October 2006 we entered into a $248.0 million loan agreement in connection with the purchase of 25 used aircraft. We currently have 79 new A320 family aircraft on order and have signed a letter of intent to acquire 20 new A330-200 widebody aircraft from Airbus. If we acquire all 99 of the Airbus aircraft, over the next four years, we would expect to incur in excess of $4.0 billion of indebtedness to finance the purchase price of the aircraft. High levels of indebtedness may limit our cash flow available for capital expenditures, acquisitions and other general corporate purposes and may have a material adverse effect on our earnings and growth prospects.

In addition, covenants in some of the indebtedness incurred by our subsidiaries prevent our subsidiaries from paying dividends to us if we or the relevant subsidiary do not meet specified financial ratios. The terms of the Aircraft Lease Securitisation indebtedness allow for distributions on the subordinated notes held by us only after the senior classes of notes are repaid.

Aircraft have limited economically useful lives and depreciate over time, which can adversely affect our financial condition and growth prospects.

As our aircraft age, they will depreciate and generally the aircraft will generate lower revenues and cash flows. If we do not replace our older depreciated aircraft with newer aircraft, our ability to maintain or increase our revenues and cash flows will decline. In addition, since we depreciate our aircraft for accounting purposes on a straight line basis to the aircraft's estimated residual value over its estimated useful life, if we dispose of an aircraft for a price that is less than the depreciated book value of the aircraft on our balance sheet, we will recognize a loss on the sale.

22

In the past we have identified material weaknesses in our internal controls over financial reporting. Our failure to achieve and maintain effective internal controls could have a material adverse effect on our business in the future and on our access to the capital markets.

Although we are not currently subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, we are in the process of documenting and testing our internal controls in order to enable us to satisfy those requirements as of December 31, 2007. During the preparation of our fiscal 2005 financial statements, material weaknesses were identified pertaining to internal controls over the accounting for derivatives, the accounting for maintenance accruals and the accounting for defeased liabilities, each of which resulted in restatements of our consolidated financial statements. See Note 1 to our audited consolidated financial statements contained in this prospectus.

Although we are taking measures to remediate these weaknesses, including establishing a stand-alone internal audit function, building out our accounting department with additional personnel and increasing our focus on compliance with Section 404 of the Sarbanes-Oxley Act, these remediation steps and others we may undertake in the future may not be effective in successfully remediating these material weaknesses or in preventing or identifying the same or additional material weaknesses in our internal control over financial reporting in the future. In addition, even if we are successful in identifying the same or additional material weaknesses in the future, we may not successfully remediate such weaknesses quickly or at all. Any failure to maintain adequate internal control over financial reporting or to implement required, new or improved controls, or difficulties encountered in their implementation, could cause us to report material weaknesses or other deficiencies in our internal control over financial reporting and could result in a more than remote possibility of errors or misstatements in our consolidated financial statements that would be material. Following this offering, beginning with our Annual Report on Form 20-F for fiscal year 2007, pursuant to Section 404 of the Sarbanes-Oxley Act, our management will be required to assess the effectiveness of our internal control over financial reporting, and we will be required to have our independent registered public accounting firm audit management's assessment and the operating effectiveness of our internal control over financial reporting. If our management or our independent registered public accounting firm were to conclude that our internal control over financial reporting was not effective, investors could lose confidence in our reported financial information and the value of our ordinary shares could be adversely impacted. Our failure to achieve and maintain effective internal controls could have a material adverse effect on our business in the future and on our access to the capital markets. In addition, in connection with our compliance with Section 404 and the other applicable provisions of the Sarbanes-Oxley Act, our management and other personnel will need to devote a substantial amount of time, and may need to hire additional accounting and financial staff, to assure that we comply with these requirements. Compliance may also make some of our activities more time-consuming and costly. For example, we expect these rules and regulations to make it more difficult and more expensive for us to obtain director and other liability insurance, and we may be required to incur substantial costs to maintain current levels of coverage. The additional management attention and costs relating to compliance with the Sarbanes-Oxley Act could materially and adversely affect our growth and financial results.

The advanced age of some of our aircraft may cause us to incur higher than anticipated maintenance expenses, which could adversely affect our financial results and growth prospects.

As of September 30, 2006, we owned 42 aircraft that were over ten years of age, representing 21.8% of the net book value of our aircraft portfolio. In general, the costs of operating an aircraft, including maintenance expenditures, increase as they age. In addition, older aircraft are typically less fuel-efficient, noisier and produce higher levels of emissions, than newer aircraft and may be more difficult to re-lease or sell. In a depressed market, the value of older aircraft may decline more rapidly than the values of newer aircraft and our operating results may be adversely affected. Increased

23

variable expenses like fuel, maintenance and increased governmental regulation could make the operation of older aircraft or engines less profitable and may result in increased lessee defaults. Incurring higher than anticipated maintenance expenses associated with the advanced age of some of our aircraft or our inability to sell or re-lease such older aircraft would materially and adversely affect our financial results and growth prospects.

The advent of superior aircraft and engine technology could cause our existing aircraft and engine portfolio to become outdated and therefore less desirable, which could adversely affect our financial results and growth prospects.

As manufacturers introduce technological innovations and new types of aircraft and engines, some of the aircraft and engines in our aircraft and engine portfolios may become less desirable to potential lessees. In addition, the imposition of increased regulation regarding stringent noise or emissions restrictions may make some of our aircraft and engines less desirable in the marketplace. Any of these risks may adversely affect our ability to lease or sell our aircraft or engines on favorable terms, if at all, which would have a material adverse effect on our financial results and growth prospects.

If our lessees' insurance coverage is insufficient, it could adversely affect our financial results and growth prospects.

While we do not directly control the operation of any of our aircraft or engines, by virtue of holding title to aircraft, directly or indirectly, in certain jurisdictions around the world, we could be held strictly liable for losses resulting from the operation of our aircraft and engines, or may be held liable for those losses on other legal theories. We require our lessees to obtain specified levels of insurance and indemnify us for, and insure against, liabilities arising out of their use and operation of the aircraft.

However, following the terrorist attacks of September 11, 2001, aviation insurers significantly reduced the amount of insurance coverage available to airlines for liability to persons other than employees or passengers for claims resulting from acts of terrorism, war or similar events. At the same time, aviation insurers significantly increased the premiums for third-party war risk and terrorism liability insurance and coverage in general. As a result, the amount of third-party war risk and terrorism liability insurance that is commercially available at any time may be below the amount stipulated in our leases.

Our lessees' insurance or other coverage may not be sufficient to cover all claims that may be asserted against us arising from the operation of our aircraft and engines by our lessees. Inadequate insurance coverage or default by lessees in fulfilling their indemnification or insurance obligations will reduce the proceeds that would be received by us in the event we are sued and are required to make payments to claimants, which could materially and adversely affect our financial results and growth prospects.

If we incur significant costs resulting from lease defaults it could adversely affect our financial results and growth prospects.

If we are required to repossess an aircraft or engine after a lessee default, we may be required to incur significant unexpected costs. Those costs include legal and other expenses of court or other governmental proceedings, including the cost of posting surety bonds or letters of credit necessary to effect repossession of aircraft or engine, particularly if the lessee is contesting the proceedings or is in bankruptcy. In addition, during these proceedings the relevant aircraft or engine is not generating revenue. We may also incur substantial maintenance, refurbishment or repair costs that a defaulting lessee has failed to pay and that are necessary to put the aircraft or engine in suitable condition for re-lease or sale. It may also be necessary to pay off liens, taxes and other governmental charges on the

24

aircraft to obtain clear possession and to remarket the aircraft effectively, including, in some cases, liens that the lessor may have incurred in connection with the operation of its other aircraft. We may also incur other costs in connection with the physical possession of the aircraft or engine.

We may also suffer other adverse consequences as a result of a lessee default and the related termination of the lease and the repossession of the related aircraft or engine. Our rights upon a lessee default vary significantly depending upon the jurisdiction and the applicable law, including the need to obtain a court order for repossession of the aircraft and/or consents for de-registration or re-export of the aircraft. When a defaulting lessee is in bankruptcy, protective administration, insolvency or similar proceedings, additional limitations may apply. Certain jurisdictions give rights to the trustee in bankruptcy or a similar officer to assume or reject the lease or to assign it to a third party, or entitle the lessee or another third party to retain possession of the aircraft or engine without paying lease rentals or performing all or some of the obligations under the relevant lease. In addition, certain of our lessees are owned in whole, or in part, by government-related entities, which could complicate our efforts to repossess our aircraft or engines in that government's jurisdiction. Accordingly, we may be delayed in, or prevented from, enforcing certain of our rights under a lease and in re-leasing the affected aircraft or engine.

If we repossess an aircraft or engine, we will not necessarily be able to export or de-register and profitably redeploy the aircraft or engine. For instance, where a lessee or other operator flies only domestic routes in the jurisdiction in which the aircraft or engine is registered, repossession may be more difficult, especially if the jurisdiction permits the lessee or the other operator to resist de-registration. We may also incur significant costs in retrieving or recreating aircraft or engine records required for registration of the aircraft or engine, and in obtaining the certificate of airworthiness for an aircraft. If we incur significant costs repossessing our aircraft or engines, are delayed in repossessing our aircraft or engines or are unable to obtain possession of our aircraft or engines as a result of lessee defaults, our financial results and growth prospects may be materially and adversely affected.

If we provide MRO services to third-parties, we may lose some of our existing MRO service provider customers who lease our engines and purchase our parts.

A significant portion of our short-term engine leases are to engine MRO service providers, which in turn use the engines to provide their customers with spare engines while the MRO service provider repairs the customer's engines. Also, a significant portion of our engine parts are sold directly to our engine MRO service provider customers. If we provide MRO services directly to third parties we would compete directly with some of our MRO service provider customers. Some of these MRO service provider customers may choose to lease engines and purchase parts from our competitors with whom they do not directly compete in their MRO business.

If our lessees fail to appropriately discharge aircraft liens, we may be obligated to pay the aircraft liens, which could adversely affect our financial results and growth prospects.

In the normal course of their business, our lessees are likely to incur aircraft and engine liens that secure the payment of airport fees and taxes, custom duties, air navigation charges, including charges imposed by Eurocontrol, landing charges, crew wages, repairer's charges, salvage or other liens that may attach to our aircraft or engine. These liens may secure substantial sums that may, in certain jurisdictions or for certain types of liens, particularly liens on entire fleets of aircraft, exceed the value of the particular aircraft or engine to which the liens have attached. Aircraft and engines may also be subject to mechanical liens as a result of routine maintenance performed by third parties on behalf of our customers. Although the financial obligations relating to these liens are the responsibility of our lessees, if they fail to fulfill their obligations, the liens may attach to our aircraft or engines and ultimately become our responsibility. In some jurisdictions, aircraft and engine liens may give the

25