PROSPECTUS SUPPLEMENT

(To Prospectus Dated October 19, 2021)

$21,000,000,000

AerCap Ireland Capital Designated Activity Company

AerCap Global Aviation Trust

$1,750,000,000 1.150% Senior Notes due 2023

$3,250,000,000 1.650% Senior Notes due 2024

$1,000,000,000 1.750% Senior Notes due 2024

$3,750,000,000 2.450% Senior Notes due 2026

$3,750,000,000 3.000% Senior Notes due 2028

$4,000,000,000 3.300% Senior Notes due 2032

$1,500,000,000 3.400% Senior Notes due 2033

$1,500,000,000 3.850% Senior Notes due 2041

$500,000,000 Floating Rate Senior Notes due 2023

Guaranteed by AerCap Holdings N.V.

AerCap Ireland Capital Designated Activity Company, a designated activity company with limited liability incorporated under the laws of Ireland (the “Irish Issuer”), and AerCap Global Aviation Trust, a Delaware statutory trust (the “U.S. Issuer” and, together with the Irish Issuer, the “Issuers”), are offering $1,750,000,000 aggregate principal amount of 1.150% Senior Notes due 2023 (the “2023 Notes”), $3,250,000,000 aggregate principal amount of 1.650% Senior Notes due 2024 (the “2024 Notes”), $1,000,000,000 aggregate principal amount of 1.750% Senior Notes due 2024 (the “2024 NC1 Notes”), $3,750,000,000 aggregate principal amount of 2.450% Senior Notes due 2026 (the “2026 Notes”), $3,750,000,000 aggregate principal amount of 3.000% Senior Notes due 2028 (the “2028 Notes”), $4,000,000,000 aggregate principal amount of 3.300% Senior Notes due 2032 (the “2032 Notes”), $1,500,000,000 aggregate principal amount of 3.400% Senior Notes due 2033 (the “2033 Notes”), $1,500,000,000 aggregate principal amount of 3.850% Senior Notes due 2041 (the “2041 Notes” and, collectively with the 2023 Notes, the 2024 Notes, the 2024 NC1 Notes, the 2026 Notes, the 2028 Notes, the 2032 Notes and the 2033 Notes, the “Fixed Rate Notes”) and $500,000,000 aggregate principal amount of Floating Rate Senior Notes due 2023 (the “Floating Rate Notes” and, together with the Fixed Rate Notes, the “Notes”). The Notes will be issued pursuant to an indenture, to be dated as of the closing date of this offering (as supplemented or otherwise modified from time to time, the “Indenture”), among the Issuers, the guarantors (as defined below) and The Bank of New York Mellon Trust Company, N.A., as trustee (the “Trustee”).

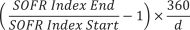

The Issuers will pay interest on the 2023 Notes semi-annually in arrears on April 29 and October 29 of each year, commencing on April 29, 2022. The 2023 Notes will mature on October 29, 2023. The Issuers will pay interest on the 2024 Notes semi-annually in arrears on April 29 and October 29 of each year, commencing on April 29, 2022. The 2024 Notes will mature on October 29, 2024. The Issuers will pay interest on the 2024 NC1 Notes semi-annually in arrears on April 29 and October 29 of each year, commencing on April 29, 2022. The 2024 NC1 Notes will mature on October 29, 2024. The Issuers will pay interest on the 2026 Notes semi-annually in arrears on April 29 and October 29 of each year, commencing on April 29, 2022. The 2026 Notes will mature on October 29, 2026. The Issuers will pay interest on the 2028 Notes semi-annually in arrears on April 29 and October 29 of each year, commencing on April 29, 2022. The 2028 Notes will mature on October 29, 2028. The Issuers will pay interest on the 2032 Notes semi-annually in arrears on January 30 and July 30 of each year, commencing on January 30, 2022. The 2032 Notes will mature on January 30, 2032. The Issuers will pay interest on the 2033 Notes semi-annually in arrears on April 29 and October 29 of each year, commencing on April 29, 2022. The 2033 Notes will mature on October 29, 2033. The Issuers will pay interest on the 2041 Notes semi-annually in arrears on April 29 and October 29 of each year, commencing on April 29, 2022. The 2041 Notes will mature on October 29, 2041. The Issuers will pay interest on the Floating Rate Notes quarterly in arrears on March 29, June 29, September 29 and December 29 of each year, commencing on December 29, 2021. The Floating Rate Notes will mature on September 29, 2023. Interest on the Floating Rate Notes will reset quarterly and will be equal to compounded SOFR (as defined in this prospectus supplement) applicable to the relevant interest period plus 0.680%, as described under “Description of Notes—Floating Rate Notes.”

We intend to use the net proceeds from this offering to fund a portion of the cash consideration to be paid in the GECAS Transaction (as defined in this prospectus supplement) and to pay related fees and expenses, with any excess proceeds to be used for general corporate purposes. The closing of this offering is not conditioned upon the completion of the GECAS Transaction, which, if completed, will occur subsequent to the closing of this offering. In the event, however, that the GECAS Transaction is not completed on or before the earliest of (i) June 9, 2022, (ii) the valid termination of the Transaction Agreement (as defined in this prospectus supplement) (other than in connection with the completion of the GECAS Transaction) and (iii) our determination based on our reasonable judgment (in which case we will notify the Trustee in writing thereof) that the GECAS Transaction will not close, we will be required to redeem all of the outstanding Notes at a redemption price equal to 101% of the aggregate principal amount of the Notes, plus accrued and unpaid interest, if any, to, but excluding, the redemption date. See “Description of Notes—Special Mandatory Redemption.”

Prior to October 29, 2023, in the case of the 2023 Notes (the maturity date of the 2023 Notes), September 29, 2024, in the case of the 2024 Notes (1 month prior to the maturity date of the 2024 Notes), October 29, 2022, in the case of the 2024 NC1 Notes (2 years prior to the maturity date of the 2024 NC1 Notes), September 29, 2026, in the case of the 2026 Notes (1 month prior to the maturity date of the 2026 Notes), August 29, 2028, in the case of the 2028 Notes (2 months prior to the maturity date of the 2028 Notes), October 30, 2031, in the case of the 2032 Notes (3 months prior to the maturity date of the 2032 Notes), July 29, 2033, in the case of the 2033 Notes (3 months prior to the maturity date of the 2033 Notes) and April 29, 2041, in the case of the 2041 Notes