(2) Holdings ceases to own, directly or indirectly, 100% of the issued and outstanding Voting Stock of either Issuer, other than director’s qualifying shares and other shares required to be issued by law;

(3) (a) all or substantially all of the assets of Holdings and the Restricted Subsidiaries, taken as a whole, are sold or otherwise transferred to any Person other than a Wholly-Owned Restricted Subsidiary or one or more Permitted Holders or (b) Holdings consolidates, amalgamates or merges with or into another Person or any Person consolidates, amalgamates or merges with or into Holdings, in either case, in one transaction or a series of related transactions in which immediately after the consummation thereof Persons beneficially owning (as defined in Rules 13d-3 and 13d-5 under the Exchange Act) Voting Stock representing in the aggregate a majority of the total voting power of the Voting Stock of Holdings immediately prior to such consummation do not beneficially own (as defined in Rules 13d-3 and 13d-5 under the Exchange Act) Voting Stock representing a majority of the total voting power of the Voting Stock of Holdings or the applicable surviving or transferee Person (or applicable parent thereof); provided that this clause (3) shall not apply (i) in the case where immediately after the consummation of the transactions Permitted Holders beneficially own Voting Stock representing in the aggregate a majority of the total voting power of Holdings or the applicable surviving or transferee Person (or applicable parent thereof) or (ii) to a consolidation, amalgamation or merger of Holdings with or into a (x) Person or (y) Wholly-Owned Subsidiary of a Person that, in either case, immediately following the transaction or series of transactions, has no Person or group (other than Permitted Holders) that beneficially owns Voting Stock representing 50% or more of the voting power of the total outstanding Voting Stock of such Person and, in the case of clause (y), the parent of such Wholly-Owned Subsidiary guarantees Holdings’ obligations under the Notes and this Indenture; or

(4) Holdings shall adopt a plan of liquidation or dissolution or any such plan shall be approved by the shareholders of Holdings.

“Change of Control Triggering Event” means the occurrence of both a (1) Change of Control and (2) Below Investment Grade Rating Event.

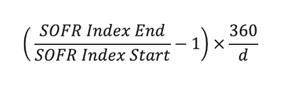

“Compounded SOFR” means, with respect to any Interest Period and the Interest Payment Determination Date in relation to such Interest Period, the rate (rounded, if applicable, to the nearest one-hundredth of a percentage point) (i) calculated by the Calculation Agent on such Interest Payment Determination Date as set forth below or (ii) calculated in accordance with Section 2.07:

where:

“SOFR Index Start” means (i) for Interest Periods other than the initial Interest Period, the SOFR Index value on the immediately preceding Interest Payment Determination Date and (ii) for the initial Interest Period, the SOFR Index value on October 27, 2021;

5